Mobile games and mobile gaming have been seeing a steady rise. And as the proverb goes: “All work and no play makes Jack a dull boy.” This simple saying rings very much true in today’s society and popular culture. Casual gamers treat playing mobile games as quality time off from work. Some even consider it a quick escape from the rigors and worries of daily life. But for gaming enthusiasts and fanatics, it’s more than just a hobby or a pastime. It is a way of life.

In this guide, we’ll discuss everything you need to know about mobile games. From informative write-ups on the platforms and genres to instructionals on how to record or stream your games, we have them all. Let this be your ultimate guide on the wonderful and dynamic world of mobile games.

First, what are mobile games all about? How do we clearly define them?

In its most general sense, mobile games are games played on a mobile device. They are created and designed to run on handheld devices. This is the part where it gets interesting. A mobile device can refer to any portable device that enables user input. Mobile devices range from smartphones, feature phones, tablets, personal digital assistants, and smartwatches. Portable media players, pocket PCs, and even graphing calculators are also included. With many different kinds of mobile devices, any game that’s played on them can be considered “mobile.” Even laptops and handheld video game consoles can contend too. However, there is one true ruler of mobile game platforms at present: the mobile phone.

So to draw the line, this write-up will zero-in on mobile games played on smartphones.

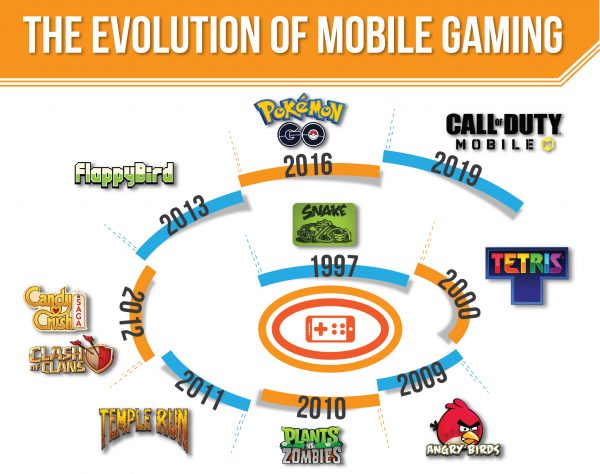

The Evolution of Mobile Gaming

The Evolution of Mobile Gaming

As mentioned, the mobile phone is where it’s at when mobile games are concerned. Mobile gaming and smartphones are almost synonymous with each other nowadays. You can’t seem to imagine one without the other. And as long as technology continues to advance between them, their union will follow.

The Snakes — 1997

But can you believe that about 20 years ago, we were just playing Snakes on the bulky Nokia mobile phones? So, let’s stroll a bit back to 1997. It’s the year when Nokia launched Snake, the most popular early mobile game on phones. The snake came preinstalled on several handsets manufactured by Nokia. Found on more than 400 million mobile devices, it has since become one of the most played games in history.

Tetris — 2000

A few years shortly after, Tetris came ringing on the door and crowned one of the most addicting arcade tile-matching games ever invented in the year 2000. Before iPhone exists, this game was popular on iPods where you use those wheels to navigate and stack those puzzle pieces into neatly arranged piles.

Angry Birds — 2009

As nostalgic as Tetris can be, Angry Birds can be beaten off-the-chart in any way. Since its release in 2009, every already seems to jump into the bandwagon to challenge this game with friends and family. This game mainly focuses on the multi-colored birds trying to save their eggs from their enemies aka the green pigs. Though it might be one of the most mainstream games out there, it releases certainly brings more fun than anything else.

Plants vs Zombies — 2010

A decade after, there go the ‘Plants vs Zombies.’ All it takes for you to stand out from this game is to protect your crops from the hungry zombies. It was rated one of the most challenging games in 2010 and shortly after that, Plants vs Zombies 2 over-throned its first version of becoming the most successful game ever released.

Temple Run — 2011

However in the following years, the running game — Temple Run blew up on iOS and it became available on Android quickly after. It wouldn’t be a surprise to find out there are still plenty of mobile phone users have this mobile game on their phone.

Clash of Clans & Candy Crush Sage — 2012

In 2012, it’s arguable one of the best years for mobile gamers. Most of the mobile users can be seen either clashing or crushing and it’s all thanks to the launch of Clash of Clans and Candy Crush Saga. Though both of these games feature distinctive different gameplay, they are equally addicting. So, whether you’re into building your empire to clash with your villages or to advance by crushing those candy stacks.

Flappy Bird — 2013

Two years after, the classic Flappy Bird took a big hit since its launch. Though it doesn’t feature outstanding graphics, it’s certainly addicting enough to keep everyone raves about it. All it does is you have to slide to the scroller to allow the bird to fly without hitting the pipes.

Pokémon Go — 2016

Remember those days where you’re busy running out of an empty field just to catch a Pokemon? Yes, we’re referring to 2016. This game is no brainer and all you need is to allow your GPS to locate, catch, and train virtual creatures that appear on your mobile displays. Just if you thought this game is slowing fading away. Think otherwise. In fact, Pokemon still exists and it doesn’t seem like it’s going away anytime soon.

Call of Duty: Mobile — 2019

In 2019, the ironic Call of Duty: Mobile finally released and it’s has then received the attention beyond expectations. Featuring iconic multiplayer maps and modes, this first-person shooter mobile game brings in a heady mix of action and challenges that you ever wished for as a mobile game. Its revolutionized graphics came shockingly different as compared to the games you’ve ever played decades ago. From the basics of the past to the more sophisticated ones of today, mobile games have truly come a long way.

What Are The Genres of Mobile Games?

What Are The Genres of Mobile Games?

We spend countless time scrolling our mobile phones daily. In most cases, it’s either we’re browsing the internet, social media, or playing games on the mobile phone. When we drill down to the statistics of how much time we spend each month to play mobile games, you wouldn’t have believed that it equates to a whopping for 1.15 billion hours. Though mobile games nowadays come in all types and classifications, the time we spend playing these games remains relatively consistent. But, what are the types of mobile games, and what’s are the recommended games to play?

Before we dive right in, let’s be clear that these games are distinctive in terms of its gameplay, designs, graphics, and more that caters to different target audiences. Whether you’re those who are into challenging brain training games or action games, you’ll get it. So, if you’re in search of the best games or the most addicting games, here’s everything you need.

Best Action Mobile Games

Action games are one of the most addicting games and also the most varied genre of mobile games as well. They focus on physical challenges that require hand-eye coordination and reaction time. Players control a character that must navigate levels. They avoid obstacles, collect items, and battle enemies using weapons and tools. The character must also defeat a more challenging boss enemy at the end of levels. Enemy attacks deplete the character’s health and lives, which can result in a game over when they run out.

PUBG Games

PlayerUnknown’s Battlegrounds, better known as PUBG, is the most popular multiplayer battle royale game for mobile nowadays. Its gameplay is simple. Players have to participate in a death match where up to 100 players fight in warfare. The last man standing will be the winner. Players can choose to join the game solo, duo, or in a small group. All players will start with no gear and they have to search for weapons on buildings within the battleground. The game is pretty similar to Fornite Battle Royale, except it doesn’t have a Minecraft-like building element. Some of the notable ones are Rules of Survival, Ring of Elysium, H1Z1: King of the Kill, and Rust Battle Royale.

Games like PUBG have to be played online. That’s why a strong internet connection is a basic requirement. Also, your mobile phone specs are a major consideration. For Android users, we recommend Android 5.1 or higher with at least 2GB of RAM. For Apple users, games like PUBG should run seamlessly on iOS 9 and above.

First Person Shooter Games

First Person Shooter is among the most intense games of skill out there. To win the game, it needs eyes, hands, and mental coordination. The main goal of this type of game is to get as many kills as you can. Savageness is the key here.

In this genre, players have a first-person point of view when shooting. This means you can see the action of the game as if you are inside of the game yourself. FPS usually takes place in 3D, giving players a realistic view of the battleground. In FPS, you’ll have to fight against a number of enemies while trying not to be killed. Your character’s life depends on how much you know your weapon.

Games like Into The Dead, COD, Infinity Ops, and Modern Combat fall under this genre. Here are the top first-person shooter games for mobile we’ve curated for you.

Third Person Shooters Games

If there are First Person Shooters, there are Third Person Shooters. These two types of games are very similar as they both are a subgenre of shooter games. The only difference is that Third Person Shooters take place in a 2D environment. In simple terms, the players can only see from behind their characters. Third-person shooters give you a clearer view of your character’s surroundings.

The players of Third Person Shooters should also choose an avatar and weapons before going into a battle. Some Third Person Shooter titles combine the elements of FPS and brawlers where they have to fight against enemies using hand-to-hand combat. Still, the goal is to get as many kills as you can and win as the last man standing.

Famous games that fall under this genre include Splinter Cell: Blacklist, Hitman, Tomb Raider, The Last of Us, and Uncharted 4. Here are the best third-person shooter games.

Shoot’Em Ups Games

Shoot ‘Em Ups or “shmup” is another subgenre of shooter games and an action game at its core. In this game, players have to shoot a large number of enemies while avoiding their fire. As compared to TPS and FPS, shmup has much less complicated gameplay and design elements. Most shmup players take an avatar of a spacecraft shooting animated objects. The players have to simply scroll up and down to dodge the fires coming from enemies.

There are lots of classic Shoot ‘Em Up mobile games that we loved in our childhood. This includes Fantasy Zone, Space Invaders, River Raid, and Space Impact for Nokia. Some of the modern Shoot ‘Em Ups you will love nowadays are Pawarumi, Devil Engine, and Sky Force Reloaded. We’ve listed down the best Shoot ‘Em Ups For Mobile here.

Fighting Games

Fighting Games is a subgenre of action games that involve close combat battle between a number of players. The game usually takes place in an arena, or any field with boundaries, where players have to fight until they get their opponents or the time ends.

Each character in the game has unique abilities and special moves. They can unlock this through a series of movements like ducking, kicking, jumping, and sliding. That aside, players also have to master techniques like blocking an attack, counter-attacks, and combo moves. Fighting Games usually have several rounds with specific time frames. The player who wins most rounds will be the winner.

There are a handful of video games that fall under this genre. Some of the most prominent ones include Tekken, Street Fighter, and Super Smash Bros. Check out the best fighting games for all mobile devices you can play nowadays.

Beat’Em Up Games

People often confuse Beat ‘Em Up with Fighting Games. We can say that Beat ‘Em Up is a fighting game in some ways. But there is a thin line between them that makes one distinct from the other.

Beat ‘Em Up, or as other people call brawler, is a specific game genre where players have to engage in hand-to-hand combat against a large number of computer-generated opponents. Also, Beat ‘Em Up doesn’t necessarily take place in an arena. Often, it features an open environment where players, through their characters, have to move around to search and destroy enemies. In some Beat ‘Em Up games, there are scattered melee weapons that players can use. Players have to kill all enemies before advancing to the next level or section of the game.

Brawler originally includes a single player, but later versions included cooperative gameplay and multiplayer modes. Some of the best modern games under this genre are Kung Fury: Street Rage, Fightback, Blaze of Dragon, and Hero Fighter X. Here are the rest of our picks for Beat ‘Em Up Games for mobile.

Best Adventure Mobile Games

Adventure games were one of the earliest games ever created. Like action games, a player assumes the role of a protagonist. This game category revolves around an interactive story. Players often explore and solve puzzles by interacting with people and the environment. It’s arguably one of the most addicting mobile games ever invented. Here’s all that you need to know.

Stealth Games

Stealth game is a combination of other game genres like first-person shooters and platformers. But unlike the usual battle royale, being savage and aggressive is not the key to win in this kind of game. Stealth games are like virtual hide and sick games where you avoid being caught by enemies while silently attacking them.

The idea of the game is to remain undetected and avoid confrontation by hiding on objects or shadows and doing disguises. Hence, stealth. It’s up to the players if they want to attack a guard face-to-face. But, the game rewards you with more points the more you use stealths. You have to complete a certain mission without being detected to win.

There might not be so many actions in Stealth games. But it will surely test your patience, reflexes, and tactical skills. Some of the well-known stealth games are Gunpoint, Hitman: Blood Money, and Commandos 2. There are also some Stealth games that are available for Android and iOS. Here is our list of the best stealth games for mobile.

AR Games

AR Games have totally up gaming nowadays. It gives way to a more rich, interactive, and realistic gaming experience for everyone. Some of the AR games involve catching magical creatures and fighting with aliens in the real world. But, how is this possible?

Augmented reality games add visual and 3D audio elements within gameplay in real-time. Unlike virtual reality games, it doesn’t totally block your entire view of your environment. Instead, it only adds elements to your view, like a creature, as if it exists in real life. Normally, you need a pair of AR glasses or AR headsets to play this type of game. However, these don’t come cheap. Thankfully, AR games are already available for smartphones and other mobile devices.

Some of the most played AR games on mobile today are Pokémon GO, Ingress Prime, Harry Potter: Wizards Unite, and Ghostbusters World. Here are other AR games for mobile you can play.

Best Role-Playing Mobile Games

Role-playing games allow players to take up the role of characters with specific skill sets. These games are set in imaginary worlds and faraway places. Users also make decisions and actions as they progress through the plot. Heavy storylines, diverse characters, and long gameplay are their staple elements.

Mobile RPGs Games

Role-playing video games in simple terms is a game genre where players assume the role of a fictional character and take control of its actions in a virtual world. Like the table-top RPG, it follows a narrative element where players, individual or group, go on a quest to reach a conclusion of a storyline. There are also some challenges involved in the gameplay. It includes, but not limited to, solving a puzzle and engaging in a battle. As characters succeed at every quest, they gain special powers and abilities until they reach the end of the story.

The best RPGs are available for PC. But, most of them are available for mobile use as well. Some of the favorite mobile RPGs of all time are Azur Lane, Final Fantasy, Star Wars: Knights of the Old Republic, and Titan Quest.

MMORPGs Games

Massively Multiplayer Online Role-Playing Games, or MMORPG, is a sub-genre of RPG. However, MMORPGs always involve multiplayer. Group effort is the key here. To start playing this type of game, players should first gather up, form a guild, and go on a quest. Like in RPGs, MMORPG players take control of a fictional character in the virtual world.

MMORP games’ mechanics vary from one title to another. But they are similar at the core. Most of them are centered on progression. Characters gain special abilities and experiences as they join quests. Most MMORPGs also support chats and voice messaging within their platform to facilitate interactions within teams. Some of the famous ones include Ragnarok M: Eternal Love, Crusaders of Light, Toram Online, and Arcus Online. Find out which MMORPG for mobile is the best.

Action RPGs Games

Action RPGs are another subgenre that falls under role-playing games. But if the usual RPGs focus on completing a narrative, action RPGs highlight real-time combats that spice up the game.

Players have to choose their characters, either fictional or fantasy. They have to control it while trying to gain more special abilities and experience points. Most action RPGs employ shooter games and brawl within their gameplay. RPGs also have a mission system to follow, which usually happens in a dungeon, mountains, or abandoned ruins. Despite the relatively small screen, playing this type of game on a handheld device makes a different kind of experience. Some of the most played RPGs on mobile are Mount and Blade: Warband, Another Eden, Eternium, and Exiled Kingdoms. Here are other action RPGs for mobile we cherry-picked for you.

Best Simulation Mobile Games

A very diverse category, simulation games are designed to mirror real-world activities. They can also be set in fictional realities. Simulation games copy real-life activities. Players can freely control characters and environments as well. Aside from the main purpose of entertainment, they can also be used for training and analysis.

City Building Games

City Building Games are a subgenre of simulation games. It has been around for decades and is continuously gaining a large user base, especially young players. This genre revolves in one central goal, that is to build a metropolis or a colony from scratch.

This genre challenges the players’ creativity and allows them to engineer a village based on their preference. Players will serve as the leader of the civilization they are building and be responsible for its growth. It can be a high-rise city or a civilization in space. The setting varies on titles you play. The basis of success in this game depends on how you can strike a balance between your resources and your population’s success.

Franchises like SimCity, Utopia, and Stronghold were some of the classic city-building games. With the popularity of mobile gaming, there has also been a sudden surge in city-management games that have different mechanics. Despite some traditional followers saying that city-building games of the yesteryears are still better than those of today, titles like The Battle of Polytopia, Fallout Shelter, and SimCity BuiltIt have still managed to dominate mobile gaming.

Life Simulation Games

Life simulation games are also getting more popular nowadays. This subgenre of simulation video games requires maintaining a population of autonomous creatures and organisms. Not to be confused with role-playing, there is no storyline to follow in this type of game. Players just have to control the day to day lives of their characters in a virtual environment.

There are types of Life simulation games. The common ones are virtual pets, biological simulation, and social simulation. In pet simulation, players have to take care of a “pet” like feeding, taking a bath, and tuck into sleep. The classic Tamagotchi falls under this. Under biological simulation, players have to control a group of creatures while trying to make them survive through time. On the other hand, social simulation is where players take control of human artificial lives while exploring social interaction and relationships.

The Sims, Escapists 2, Godus, and Fallout Shelter are among the life simulation games you can play on mobile today. Here are other life simulation games for mobile.

Building Games

In the most general sense, building games is similar to city-building games where players design and build architecture. However, in building games, you don’t necessarily have to build a whole metropolis or colony. Your projects can only be as simple as a bridge and other very specific structures.

The rest is similar to city building games. Players would usually earn money as they build a structure, which they can use to buy materials. As the city they build grows, more people add to their community. Minecraft, City Mania, Little Builders are some of the popular building games for mobile.

Best Strategy Mobile Games

Strategy games’ gameplay requires skillful thinking and careful planning to achieve victory. They usually involve taking turns on a battlefield or some other arena. Its two main sub-types are turn-based and real-time. Focus, logic, and instinct are also necessary skills to overcome the game’s challenges.

MOBA Games

MOBA games, or Multiplayer Online Battle Arena, could be the most popular game genre nowadays. This can also be considered as an MMO in which the gameplay is centered on combat.

In MOBA games, a player takes control of a single character with specific powers and abilities. Players will have to form a group to join a game and go against an opposing team. The first team to destroy the enemies’ main base will be the winner. While fighting against your enemies and getting more kills, players have to protect their bases at the same time.

When a character dies, it will be respawned back on its base. Although there is usually no limit for respawn, players should avoid getting killed as much as possible. In some MOBA games, when a team gets washed-out, the opposing team will automatically win even without destroying the main base. Mobile Legends, Legend of Ace, Arena of Valor, and Clash Royale are some of the most played MOBA games for mobile.

RTS Games

RTS Game, or real-time strategy game for starters, could be the oldest gaming genre there is. But time and time again, it redefines gaming and is now the most celebrated subgenre of strategy video games. It combines the elements of resource management, base-building, and combat.

In RTS games, players send structures and characters to secure a location within a map. In most cases, they can create more structures to help attack and destroy an enemy’s unit. Winning players will gain more resources and experiences to expand their bases or buy more structures.

Online RTS games are one of the most downloaded apps for mobile nowadays. Some of the titles that dominate mobile platforms are Clash of Clans, Dungeon Warfare 2, Iron Marines, and Anomaly. Here are the top real-time strategy games to download for mobile.

Mobile Tower Defense Games

Tower Defense Game is another subgenre that falls under the strategy games. From the term itself, the game involves defending your territory against invading forces, may it be zombies, aliens, or warcraft.

Some consider Tower Defense Games as a form of RTS due to its real-time element. But, unlike RTS Games, TDGs don’t need you to build a base. All you have to do is to deploy defending forces that will block your enemies. Some obstructions you can use are towers, canons, walls, and even rocks. However, your resources are not unlimited. The challenge is to strategize where to place obstructions.

Space Invaders is one of the first arcade video games to emerge under this genre. Modern versions include Kingdom Rush, Castle Doombad, and Fieldrunners 2. We’ve listed down the best tower defense games for mobile here.

CCGs Games

CCGs, or Collectible Card Games, are traditionally tabletop games. However, due to the popularity of online video games, CCGs have also emerged on different gaming platforms. That includes mobile.

The game starts where players create a deck of cards and challenge others for a battle. The objective of the game is to make counter-attacks and, of course, defeat the opponent. Each player will have to draw a card. Each card has characters in it and keywords indicating its powers and counter-attacks. When a player uses a card that indicates “fire” as a counter-attack, then that creature can only be blocked using a “fire” creature. CCGs usually involve two opposing players, but it can be a co-op too.

CCGs gain inspiration in early anime series. Some of the best known Collectible Card Games (CCGs) for mobile are Yu-Gi-Oh Duel Links, Shadowverse, and Hearthstone.

Best Sports Mobile Games

Sports games emulate the practice and playing of traditional physical sports. Several games emphasize actual play while some focus on sports strategy and management. In terms of gameplay, opposing teams can be controlled by another player or artificial intelligence.

Mobile Football Games

If your reflexes are too bad to play Football physically then, maybe, you can do it in a virtual field. Thankfully, there are now mobile Football games that allow you to channel the inner David Beckham in you. You can also now do a curve kick without lifting an ass.

Most of the early versions of Football games happen offline where you have to go against a computer. But, nowadays, other versions allow you to play online against other players. Football video games have the mechanics of an actual football. Only that you have to control all the players, or at least the one who has the ball. Also, the time limit of Football video games is shorter than the actual. The player who makes the most number of goals after the time limit will be the winner.

Since the mechanics of Football video games are the same, some apps focus more on graphic quality, mobility, and interface to attract users. Real World Soccer League, FIFA Soccer, and World Football League are some of our special mentions. Here are other football games for mobile you can play.

Basketball Games

As the world’s favorite sports, it’s no surprise that Basketball has also made it to video gaming. Not only it saves your physical energy, but it also allows you to practice your shooting on-the-go.

Earlier versions of Basketball games exist on different game consoles such as PSP, NES, and Xbox. Its mechanics have no difference with the actual Basketball. However, nowadays, Basketball games are no longer limited to NBA 2K franchises, where a player takes control of the whole team. Some versions of it today are specific to some part of the sport like shooting and freestyle dribbling, eliminating the teamplay element.

Some of the best basketball games for mobile include Freestyle Mobile, Tap Dunk, Free Throw Basketball, and Rival Stars Basketball.

Racing Games

Racing game is an all-time favorite genre from the time of Arcade and now with the existence of mobile gaming. It can be a first-person as if players are inside a vehicle, or a third-person perspective where the players see the back of the vehicle they are controlling.

For everyone’s knowledge, not all racing games use cars as vehicles. In fact, some are using water and spacecraft. Players have to join a racing competition and reach the finish line first to win. Other racing games take several rounds or loops. Others make the game more exciting, allowing players to leave traps and baits along the path.

Top Speed: Drag and Fast Racing, Fast & Furious Takedown, Street Racing 3D are among the impressive must-play racing games for mobile.

Golf Games

If you haven’t had the opportunity to play the sport in real life, you can now. Golf games are, as the name suggests, a virtual version of the sport. You can get the chance to play golf in the comfort of your own home.

Playing golf games is a good way to unwind. The sport is inspired by is not that complex. But it does require a great deal of brainpower. The game allows you to play at your own pace, which can be very relaxing. Alternatively, you can choose a competitive option. Some golf games have a multiplayer feature that lets you play with friends. You can also upgrade your equipment and go through various courses for an added challenge.

If you want to try playing golf games, Mini Golf King and Golf Clash are great to start with. For a fun spin, you can also try Mini Golf: Jurassic or Mini Golf Paradise Sport World.

Tennis Games

To play, you’ll be placed in a tennis court with an opponent. This opponent could either just be a system or an actual person. Depending on the game, you can also play with a partner for double. The in-game controls will vary from game to game, but you’ll have options to serve and hit the ball. It’s good practice for hand-eye coordination.

Some tennis games like Tennis Club Story have unique and colorful graphics to keep you stimulated. Others, like 3D Tennis and World of Tennis: Roaring ‘20s will make you feel like you’re actually there. There is yet to be a first-person POV tennis game, but there are a lot of good alternatives. You can find out the best tennis games in our roundup.

Billiard Games

Billiards is a fun sport you can play competitively or with friends. Whether if you’re not in the mood to go out to and play pool, or you don’t have any equipment, you can do so virtually. It’s also a great way to practice. Since the game relies on strategy, you will be able to sharpen your critical thinking as well.

If you’re worried that a virtual game won’t adhere to our laws of physics, you’ll be surprised. You will first be given a cue stick, and your goal is to shoot the colored balls into the pockets by hitting the white ball. If you’re playing with others, you’ll take turns shooting the balls into the pockets. Pool Mania and Billiards Club are great for beginners. They also support offline play if you don’t have an internet connection.

Best Multiplayer Mobile Games

Pass by hangouts and corners of malls now. It’s likely that you’ll see three or more people huddled together. Their eyes glued on their phone screens while tapping away to a victory over a multiplayer game. As a mobile game genre, a multiplayer game is not based on gameplay characteristics and interaction. It’s a game that multiple persons can play in the same setting at the same time. Most multiplayer games today require online play over the internet. Players can also either compete against each other or work cooperatively. Here’s the list of the best multiplayer games for mobile now.

Best Brain Mobile Games

From the name itself, brain games sharpen the mind. They help you exercise your brain and its functions, mostly through puzzle solving. Improved cognitive skills, logic, memory, vocabulary, concentration, and reflexes are just some benefits. You can gain these from playing games under this category.

Hidden Objects Games

These games will challenge your observational skills. You will be tasked to find specific objects in a setting. Though it may sound easy, the cluttered scenery will make it hard for you to find even the most obvious objects. Having to take time to really look for something will be hard but you will have fun doing it.

Hidden objects games can come in a variety of genres, but most prominently in Mystery. They are typically a form of finding clues in order to solve an overarching problem. But that doesn’t mean they’re boring. The intricate storylines and detailed plot will keep you on the edge of your seat. A majority of them have an entire cast of characters, colorful graphics, and intricate design.

Criminal Case, CSI: Hidden Crimes and The Secret Society are good examples of this.

Tile Matching Games

Tile matching is arguably one of the most iconic game formats out there. This simple but entertaining style of game has survived the test of time. The instructions are fairly simple — to match 3 or more tiles with the same pattern. But its simplicity doesn’t make it a no-brainer. It’s also a test of wits and strategy.

Because of its visual-heavy nature, tile-matching games have great graphics. With a colorful and playful design, you’ll surely enjoy it. It’s the best kind of game to play if you need a break from work or school. What seems like mindless fun is also a great way to sharpen your analytical skills. And you can improve your critical thinking even when you least expect it.

Candy Crush is a staple tile-matching game. But if you want to go retro, you can also check out Tetris or Chuzzle. There are also cute, animal-themed games like Pet Pop available for free. For the more adventurous mobile gamers, Puzzles and Dragons may be for you.

Trivia Games

If you’ve ever watched Jeopardy and thought, “I could have answered that better,” this is for you. Make your trivia show dreams a reality all in the comfort of your home. Although you won’t be playing for money (all the time). Which, surprisingly, doesn’t take the fun out of it as you’d think.

If you have a lot of random general knowledge, you can show them off here. Not only that, but you get the opportunity to learn more in the process. It’s a great way to keep your mind sharp during the summer or at the weekends. You can even have fun with friends or family using multiplayer trivia games. It’s time to put those seemingly useless facts you’ve accumulated to good use.

Quiz Panic and QuizUp are great examples of multiplayer trivia games. There are also games like HQ Trivia, a free app where you can win actual money. It’s like being in a game show. If you’re looking to play these trivia games, you can check out our top picks.

Word Games

If you’re a voracious reader, or just have a knack for words, you might want to check this out. As its name suggests, word games involve playing around with words. Word games do a good job of keeping your mind sharp. So if you’re bored, these will entertain and train you at the same time.

Scrabble or crossword fans will rejoice. These word games are free to play and easily accessible. You can show off your linguistic prowess and even bond with friends. But it’s not always about who knows the longest words. Any Scrabble expert will tell you that you can beat the opponent even with a three-letter word. (If strategically placed, that is.) You will have to strategize and exercise critical thinking as well.

Scrabble Mobile and Online Crosswords are available for download. But there are also games with a more modern spin on word games. These include Wordscapes, Word Connect, TypeShift, and more. Multiplayer games like Words with Friends and WordFeud are great choices.

Text-based Games

Text-based games are another classic game format. Today’s games are full of intricate environments and meticulous character designs. And while that’s a great improvement for gamers, it can get a little overwhelming.

Though you may not get good graphics, it will still stimulate your brain. Not only will you have to use strategy, but imagination as well. Think of it as an interactive, gamified novel. The best part is that you can’t contain this type of game in one genre. Its versatile format allows developers the liberty to take the story anywhere. From medieval kings to spaceships and robots, there are a ton of options for you.

Some argue that text-based games are going out of style. But this only drives developers to think of creative ways to attract mobile gamers. Even players with short attention spans won’t regret checking it out. Uniquely designed text-based games include Reigns, Choice of Robots, Simulacra, and more.

What Are The Best Mobile Games To Play Now?

What Are The Best Mobile Games To Play Now?

Taking away from the previous section, classifications are not set in stone. Mobile game genres are open to subjective interpretation. A single game can contain different elements and fall under several genres at once. Best-of and top-ranking lists also fit this description. They can be run down based on personal feelings, tastes, and opinions. Nonetheless, making lists like these are entertaining as hell. Below are our listicles for the best mobile games per specific demographic.

Best Mobile Games for Adults

Let’s start with mobile games for adults. Yes, adulting is hard but it has its own perks. You can enjoy things that weren’t allowed at a young age. Playing and trying your luck in the casino is one example. Fortunately, you can play online casino on your smartphones now. You can start betting now on these top slots games, poker games, and blackjack games for mobile.

Slot Games

Slot games are a digital take on the casino games of the same name. It operates pretty much the same way: you need to get the same pattern across the board. If casino slot games are any indication, these are also highly addictive. You don’t have to go to Las Vegas to see the slot machines. You can do it in the safety of your own home.

Slot games will induce the same instant gratification with lesser risk. You may not win money, but you’ll get the enjoyment of playing the actual game. Titan’s Wrath and Pirates of the Dark Seas are unique spins on this genre. You can even win actual money from the latter. Here are some of the best slot games in the market curated for you.

Poker Games

If you’re great at card games but bad at keeping a poker face, mobile poker games might be your thing. You’ll get the chance to play with people without the risk of getting caught in your bluff. In these games, you will be given cards by an automated dealer. From there, you can try to earn points and win the game with standard poker rules.

Poker games are versatile and available to play on laptops and PC. But for more accessible gameplay, there are a lot of mobile apps you can try. You’ll get to play with many players all around the globe as well. Some games will allow you to create an avatar that can interact with other players. The Wild Poker, WSOP Poker, Poker Stars and Poker Arena are some of the perfect examples.

Blackjack Games

Blackjack is another popular card game you can play in the casino. Mobile blackjack is as close to playing the real-life card game as you can get. Many Blackjack games come in multiplayer, so you can play with others online.

Much like poker games, you will get dealt with cards from an automated dealer. Some Blackjack games will even let you chat and interact with players like real life. Aside from the realistic graphics and interactivity, you get to track your stats and see your improvement. You might not get physical cash in return, but you will still get the rush of winning at Blackjack. The Blackjack Strategy Practice, Blackjack Casino Style and BlackJack 21 are just some of our picks.

Best Mobile Games for Couples & Kids

Has your relationship gotten stale? Playing games together at home is a great bonding experience. You can share quality time with your partner while having fun. Essentially, games for couples include multiplayer games where you can take turns. Casual and alternative games like Candy Crush or rhythm games are loads of fun as well. But, games like Pokémon Go where you can explore together and catch them all can be the cherry on top. When it comes to family-oriented fun, nothing beats the classic board games. Every parent wants to ensure their children are playing age-appropriate games too. So, check out these free kids’ games on mobile.

How to Download Mobile Games on PC?

How to Download Mobile Games on PC?

Of course, playing a mobile game on your PC requires you to have the app downloaded and installed. Most emulators for Android and iOS have their own native stores where you can download games. On the other hand, some emulators come with excellent features of app store integration. These programs are either connected to iOS’ App Store or Android’s Google Play. They allow you to download and install apps and games directly from these digital stores.

BlueStacks is a prime example. It’s the most well-known Android emulator. Considered as the best for the said OS, it has millions of users worldwide. Though some antiviruses detect it as malware, you can read here why BlueStacks is safe to use. The guide also provides steps on how to install it on both Windows and Mac PCs.

How to Play Mobile Games on PC?

How to Play Mobile Games on PC?

After you’ve installed an emulator on your desktop, then you’re just a step away from playing your games. But before that, it’s best if you explore your emulator’s settings. Tuning them up first will give you the best gaming experience. Some of the most important settings to take note of are:

- Display resolution

- Graphics engine mode

- DPI (dots per inch or mouse sensitivity)

- Number of CPU cores

- RAM allocation

- Keyboard and gamepad controls

- Device location features (for location-based games)

Emulators let you customize settings to a great extent, enhancing gameplay even more. Yet, all software contains bugs from time to time like compatibility issues. So it would be a great idea not to depend on only one emulator. Consider other options for backup. For more info on emulators for Android and iOS games as well as how to play mobile games on PC, pick your link.

How to Record Mobile Games?

How to Record Mobile Games?

So you just made a spectacular play that won you that intense game against your rivals. And you definitely want to gloat over your triumph. What you need to do is record your gameplay to achieve those much-deserved bragging rights. Lucky for you, we have a step-by-step guide on how to screen record mobile games for both Android and iOS.

Recording Mobile Games on Android Phones

There are two ways you can do such. First is through native apps on your smartphone. For Android devices, Google Play has enabled the function back in October 2015. You just have to install the Google Play Games app and click “Record Gameplay”.

Recording Mobile Games on iOS

On the other side, iOS’ recording function is a built-in one. You must launch “Settings” and go to the “Control Center”. Then tap “Customize Controls” and choose “Screen Recording”. Replaykit is another recording feature for iOS. This function is game-specific, so you have to know whether your game is Replaykit-enabled. You can find out by looking for the record button on the game itself.

Third-party apps also enable screen recording for mobile games. The previous link also contains the best options for both operating systems, so check them out.

How to Stream Mobile Games?

How to Stream Mobile Games?

Now that you’re more confident about playing mobile games, why not share the joy of it through streaming? Who knows, you might even make some money out of it.

The online streaming of gameplay is simultaneously recorded and broadcasted in real-time. Live-streaming games as a practice became popular in the mid-2010s. And with the proliferation of various platforms, it has now become a full-blown hobby and profession. Both viewers and streamers register for free accounts with these services. Then, they interact with each other and follow or subscribe to specific users. Blending high-level play and entertaining commentary, professional streamers earn income. Such earnings may come from subscriptions, donations, as well as sponsors.

Here’s an overview of the top services for streaming mobile games, along with links to in-depth articles.

| Platforms | Description | Reviews | Next Step |

|---|---|---|---|

|

Twitch is a video live streaming service operated and owned by Amazon through its subsidiary, Twitch Interactive.

|

It’s considered as the leading live streaming video service in the United States. Although focused on video game live streaming, it also caters to creative content, music, and ‘in real life’ broadcasts.

|

||

|

What can’t you do on Facebook nowadays? The social media giant recently launched its own gaming feature called Facebook Gaming.

|

Facebook’s live function allows users to stream games live and share them afterward. For mobile games, streaming is best with the Omlet Arcade app.

|

||

|

As the gaming community on YouTube has become so enormous, it created its own dedicated category named YouTube Gaming. It was launched in 2015 as a direct competitor to Twitch.

|

Users can create their own gaming channels and stream playthroughs. Both professional and amateur gamers turn to YouTube to monetize their content.

|

||

|

The Open Broadcaster Software (OBS) is a free and open-source live streaming and recording program. It’s maintained by the OBS Project.

|

OBS is also a cross-platform software, which includes presets for Twitch, Facebook, and YouTube. It also provides real-time capture and scene composition.

|

||

|

Smashcast came about after the merger of two former live streaming platforms, Hitbox and Azubu. Its operations started in May 2017.

|

The live streaming platform focuses on eSports. It’s also hailed as the biggest independent eSports broadcaster just outside of Asia with over 10 million users.

|

||

|

The mixer was initially launched as Beam in January 2016. This Seattle-based live streaming platform was acquired by Microsoft several months later.

|

This live streaming service puts emphasis on interactivity and low stream latency. It also allows viewers to act and influence a stream.

|

||

|

Bigo Live is a live social and video streaming application. It was developed in March 2016 by Singapore-based company Bigo Technologies.

|

The streaming application offers default streaming features. It also encourages users to showcase their talents using the platform.

|

||

|

AfreecaTV is a South Korea-based video streaming service. It started in 2005 as a beta service and gradually developed from thereon.

|

Aside from live video game streams, the platform also offers TV broadcasts, artist performances, and personal video blogs.

|

||

How to Hack Mobile Games?

How to Hack Mobile Games?

Hacking or cheating on games is as old as playing them. The question now: is it possible to hack or cheat in mobile games? The answer is yes, as with any other gaming platform. The only catch is it usually requires rooting your phone.

For Android, rooting is the process of allowing owners to gain root access to the device’s operating system. This provides full control over said device and access to backup data. It also allows users to install previously incompatible software. Rooting is equivalent to jailbreaking for Apple devices. Learn how to root your Android phone to access premium features and enjoy customization to suits your preferences. Here are some of the best root apps to further help you in the process.

However, if you’re an iPhone user, this step-by-step guide is here to guide you on how to jailbreak iOS easily. Yet, be reminded that these processes are done at your own risk.

However, as an open-source mobile operating system, Android has more sources for hacking mobile games. These include emulators and applications that can modify a game’s system to give you an upper hand in your games. So, start learning these Android game hacks and start advancing with minimal efforts.

Mobile Games APK

Mobile Games APK

You can download and install your mobile games mostly through the app stores. If you own an Android device, then you probably have heard of the term APK. APK stands for Android Application Package or Android Package Kit. It’s the file format used by Android to distribute and install mobile games and apps, as well as middleware. APKs consists of all the elements necessary for an app to install correctly on your phone.

Using Google Play automatically downloads and installs APKs for your device. However, these file packages are also available to download from alternative stores. A lot of apps that aren’t available on Google Play can actually be sourced from these websites. Some mobile games also appear as mod APKs. These are unofficial versions of the game. They often contain unlocked features and special content unavailable in the original app.

As a teaser, you can try these totally safe mobile game APKs by just following the links below.

What Kind of Gaming Phones Best for Mobile Games?

What Kind of Gaming Phones Best for Mobile Games?

Now we go to the good parts. So you want to play the most recent trending mobile game. Of course, you’d want to get your hands first on a really good gaming phone. It’s the only way to enjoy playing a game in all its glory. Mobile games are becoming more and more advanced in quality and gameplay. Hence, smartphone companies answer the call by amping up the specs on their devices. The usual requirements of mobile games today are:

- A fast central processing unit (CPU)

- Dedicated graphics processing unit (GPU)

- Large random access memory (RAM) and storage

- Big-sized and high-resolution display screen

- Long battery life

This list of specifications is not a one-size-fits-all solution. Mobile gamers, casual or serious, have their own priorities when it comes to gameplay. And yes, one can easily get lost in choosing what smartphone to buy to suit his or her gaming needs. Lucky for you, we have several articles to help you decide which device to get:

Criteria for a good gaming phone

Best Phablets With Bigger Display Screen

Who doesn’t want to play games on a device with a large touch screen display? The bigger, the better, right? If that’s the case, then a phablet is what you’re looking for. Phablets are mobile devices with the size format between a smartphone and a tablet. Hence, the term. Read on to know more about these big-screen phones.

Best Mobile Phones with Faster Processors

Don’t you hate it when your smartphone lags when you’re in the heat of battle? You might need to upgrade to a device with a better processor. More powerful phone processors can handle multiple tasks with ease and at high speed. Your mobile games will run as smooth as silk. Check this list of smartphones with the best mobile processors.

Best Mobile Phone with Long Battery Lifespan

A device with depleted or dying power is a gamer’s number one enemy. In fact, every phone user doesn’t want to keep plugging-in his or her device all the time. Our daily lives and tasks depend on our smartphones now more than ever. That’s why having a long-lasting battery is very important. Get to know our top picks.

Best Phone Speakers

Imagine playing your favorite action mobile game. But, with the sound quality from an explosive Michael Bay action flick. That would be awesome indeed! Phone speakers aren’t really a specification that most consumers look into. However, if you want to enjoy media to the fullest, then this list is for you.

Best Gaming Phones

If you want to cut to the chase, then you have to keep your eyes glued to this guide. All these gaming handsets integrate high-end hardware with the latest software. Big-name players and understated performers comprise the listing. And one might just give you the incredible gameplay you’ve been waiting for.

With powerful technology at our disposal, many smartphones today are dedicated gaming phones. They are built from the ground up to provide an unadulterated gaming experience. On the other hand, some argue that every phone available on the market can serve as a gaming phone of some kind. These mainstream handsets are actually versatile flagships that excel at everything including games. Our best gaming phone list consists of options from these two classifications. This buying guide will help you make an informed choice.

What Are Mobile Gaming Platforms?

What Are Mobile Gaming Platforms?

First things first. What are mobile games all about? How do we clearly define them?

In its most general sense, mobile games are games played on a mobile device. They are created and designed to run on handheld devices. This is the part where it gets interesting. A mobile device can refer to any portable device that enables user input. Mobile devices range from smartphones, feature phones, tablets, personal digital assistants, and smartwatches. Portable media players, pocket PCs, and even graphing calculators are also included.

With many different kinds of mobile devices, any game that’s played on them can be considered “mobile.” Even laptops and handheld video game consoles can contend too. However, there is one true ruler of mobile game platforms at present: the mobile phone. So to draw the line, this write-up will zero-in on mobile games played on smartphones.

development software and supported platforms

Mobile phone games from the early days had several competing development software. These include Macromedia Flash Lite, NTT DoCoMo’s DoJa, Qualcomm’s BREW, and Sun’s Java ME. The first mobile internet protocol (WAP) also emerged by this time. It combined and worked with the aforementioned platforms. This pairing enabled the sale, download, and installation of games to mobile phones. All of which became possible via wireless carrier networks.

A variety of other technologies used either to build or run mobile games also had their time. Palm OS, Symbian, BlackBerry, and early versions of Windows Mobile are names to mention. At present, Google’s Android and Apple’s iOS share the throne as the most widely supported platform. Windows 10 Mobile, formerly Windows Phone, played its part as well in this area. It was fairly supported during its run. However, its popularity and market share remained minimal compared to the two.

distribution Modes of mobile games

Throughout its history, mobile phone games have been distributed in the following:

● Preinstalled – like Snake, the game’s binary file comes preloaded on the handset. It’s done either by the original equipment manufacturer (OEM) or the mobile operator.

● Over-the-air (OTA) – the binary file is delivered and installed to the phone via mobile data services.

● Sideloading – the game file is transferred from a desktop to a mobile device via a data cable (USB). Bluetooth and Wi-Fi connections can also be used. Inserting memory cards into phones is a sideloading method as well.

● Mobile browser download – the game is directly downloaded from a mobile website.

The majority of mobile games then were also sold by the mobile networks themselves. Examples are Verizon, Sprint, and T-Mobile for the US. On the other side, Vodafone and Orange are the top carriers for game distribution in Europe.

Digital app stores

Mobile games and mobile gaming as we see them today owe a lot to Apple. The company launched the App Store in mid-2008, its own distribution service. It then ushered a revolution in mobile application and game ecosystems. Consumers are now given the choice of where to download mobile games and apps. But of course, this depends on which operating system your smartphone is running on. Soon after, rival mobile OS platforms followed suit.

Joining the App Store for iOS is Google Play for Android and Microsoft Store for Windows 10 Mobile. These are considered the three biggest app stores. Google Play was initially launched as Android Market in late 2008. Microsoft Store is now the unified distribution point by the said platform. It had its origins as Windows Phone Marketplace back in 2010. These digital download storefronts run on smartphones using the specific operating system. They provide consumers with access to thousands of applications both free and paid. They also serve as the main distribution channel for mobile games now.

Many mobile games are first released as free downloadable versions. Afterward, players are enticed to upgrade into the full and paid versions of the game. The current business model of mobile games today is referred to as “freemium.” Under this model, the game download is still free. However, it relies on separate or in-app purchases of premium features. These include additional game levels or better equipment and items. All of which brings the base game beyond its original limitations. Lastly, mobile games can also generate revenue by carrying paid advertisements.

Frequently Asked Questions:

Frequently Asked Questions:

A Tetris variant played on the Hagenuk MT-2000 device was the earliest known game on a mobile phone. This points back to 1994.

Mobile games are played a lot less than games on consoles. The majority spend around two minutes on testing out a new game. However, these numbers may change drastically depending on the mobile game’s features, gameplay, and interaction.

It’s evident that prolonged play of mobile games may stir addiction to mobile devices and playing in particular. These may lead to adverse effects on the user’s health and functions. Experts are trying to fight fire with fire through gamification. This refers to the application of game-playing elements to daily activities such as learning and physical exercise. Recent studies have shown positive results for individuals.