There are millions of apps for mobile nowadays: 2 million on Google Play and 1.8 million on the App Store. Undeniably, we need these mobile apps to accomplish more things with our mobile phones. You won’t have the best out of your phone unless you install apps on them. However, our mobile devices can only take a good number of applications. Their storages have limitations. You can use high-performing smartphones, but none of those can house unlimited mobile apps. Neither would the best memory or microSD cards help for that matter.

That’s why knowing what mobile apps you will need the most is very important to save space on your device. Never install an app out of impulse. If you do, might as well uninstall them after using them instead of leaving them unused, eating up memory space on your mobile phone.

In this extensive guide, we’ll discuss the must-have mobile apps that you should essentially have on your smartphones. From different social media apps and movie apps down to the productivity apps you can use, we’ll have them all here. Let this be your ultimate guide on the mobile apps that you should have on your mobile device. Don’t worry, most of these mobile apps are absolutely free to download.

All-Time Favorite Social Media Apps

All-Time Favorite Social Media Apps

There surely are a lot of social media apps nowadays. These could be the most downloaded type of mobile apps, and the most useful too, as it allows us to connect with people with whom we care for. It serves as a virtual community that binds and creates stronger relationships despite distance and proximity. You need to create a profile to start using these apps. From there, you can find someone you can connect to, even with people you do not personally know.

There are several types of social media apps. Some allow you to share photos, videos, others focus on facilitating community forums. While some let you share blogs and find job opportunities for you.

Facebook has the most number of users among all social media apps out there. Founded in 2004 by Harvard students, it started as a web platform that allows you to make “friends” online. That aside, users can use the app to post photos and videos, add Facebook Stories, and go live. You can also create groups, play mini-games with friends, and do fundraising.

Over the years, Facebook has added other functionality to the mobile app and is looking great more than ever. It is no longer just limited to finding new friends. Alternatively, you can learn how to use Facebook Dating to find a life partner. You can also use its virtual hub stream on Facebook Gaming. Learn more about the app’s latest features and its benefits in this Facebook app review.

Instagram is a social media app that focuses on photo sharing. But, you don’t just post ordinary photos. Normally, Instagram users share glam photos to define their lifestyle. For that, the app has various features to enhance the images you share. It has photo editing and multiple filters you can use. As if those are not enough, you can also create Instagram filters.

Aside from posting photos on Instagram, users can also add fleeting photos on the app similar to Facebook and Snapchat Stories. It also has a feature to host live videos and send instant messages. Learn more about how to use Instagram with this guide.

If you love sharing thoughts and opinions online, then you might have heard of Twitter. You might already have a Twitter account as well. But for non-users, Twitter is a social media service where you can share microblogs about anything.

A Twitter post or “tweet” was originally limited to 140 characters. But in the 2018 update, the app has increased it to 280 characters. Like in other social media apps, other users can also comment, like, and share tweets. There is also an instant messaging tool within the app to allow users to interact with each other privately. Here’s a complete guide on how to use Twitter.

TikTok

There was a sudden surge in TikTok’s popularity recently, especially among young users. Formerly exclusive in China, it is a social media app that allows users to post funny and funny videos online. It has several sounds, filters, and effects you can use to make your short clip videos more colorful and engaging.

Aside from posting videos, you can also send messages, follow someone, and add comments on videos on TikTok. It also allows select users to go live. But what makes TikTok more fun are the challenges and trends you can try. The trends in TikTok drastically change from time to time. You might want to follow them if you want to gain more followers. You can learn more about how to use TikTok here.

Who says that social media are just for flaunting your lifestyle? LinkedIn reminds us that spending time on social media can also be productive. The app combines social networks and recruitment in a single platform.

LinkedIn is a social media platform that connects professionals with career opportunities. Like a basic social media app, it allows users to add posts, connect with other people, and send messages. But what sets it apart is how it helps job seekers to land a career. Similar to job portals, LinkedIn users can upload their resumes and send applications on job openings posted on the platform. Alternatively, recruiters can also contact qualified professionals directly through the app.

That aside, Linkedin has several tools you can use to highlight your qualifications. It has a blogging platform where you can show your expertise, a job history where you can add your past jobs, and skills and endorsement to your references. Follow this article to know more about how to use the LinkedIn app.

Pinterest is a social media platform for people who love recipes, DIYs, and style. It allows users to find inspiration and ideas they are interested in through images. It is like a virtual board where people pin images and share them with their followers.

The app is not only for individual users. Pinterest can also be a helpful tool to build brands and businesses. With its visual search engine, it is much easier to find the products you need. Just take a snap of what you are looking for and Pinterest will provide you with shoppable pins. Discover how to use the Pinterest app here.

Tumblr

Tumblr combines the properties of a social media platform and a blog site. Founded in 2007, it allows users to post articles of any length that they can share with their followers. Alternatively, users can also post multimedia and other content in short-form blogs.

What makes Tumblr unique from other blog sites is its simplified platform. Posting your articles on Tumblr is much easier given its readily available themes and format. It eliminates the complicated setups of a blogging platform but still gives you an option to modify your page heavily. If you are not into blogging, Tumblr can still be a good tool for you if you only want to curate the content you like. Here’s a complete guide on how to use Tumblr on your mobile devices.

Snapchat

Snapchat started as a photo messaging app. But over the years, it has changed a lot. Nowadays, it allows users to upload fleeting multimedia content that their friends can see. The app is popular among young demographics for the fun filters and lenses. Recently, it rolled out a new feature that allows users to view locations where most of the Snapchat stories are taken. It also allows users to view their friends’ locations. Learn more about what is Snapchat and find out what are other things you can do with it here.

Most Popular Entertainment Apps

Most Popular Entertainment Apps

We can’t deny that entertainment apps have a huge part in our lives. From watching shows on TV sets, we now access hundreds and thousands of movies on the go through different movie streaming services. Once we are caught in a traffic jam or stuck in the subway, all we do is take out our phones and start binging on our favorite movies and series.

However, it’s pretty hard to choose which streaming app fits your needs. There are a lot of them on the App Store and Google Play, but not all of them are worthy of your money. In case you are still in search of the best entertainment apps for your mobile phone, here’s everything that you need.

Netflix

Who doesn’t know what Netflix is? Seriously, you must be living in a barn if you haven’t heard of this in your entire life. Netflix could be the most successful subscription-based streaming platform there is. There are about 160 subscribers to Netflix. Surprisingly, its mobile app version has a higher engagement rate.

Netflix has a very intuitive interface. It provides you with suggestions based on your previous activities, latest releases, and most-watched shows in your area. For $9 to $16, you can enjoy thousands of movies, shows, and original series on Netflix. It has bits of documentaries, animes, sci-fi, comedy, and action movies that make it appeal across all ages. The fun thing about Netflix is that you can download content you want to save for later.

Hulu

Hulu is another streaming service you might want to consider for your mobile device. Pretty much like other on-demand video streaming platforms, Hulu has exclusive series, hit movies, and originals. You can also download them for offline watching. The Handmaid’s Tale, Runaways, and Difficult People are among the popular series on the platform. If you haven’t heard any of them, then you’ve got another reason to subscribe.

The $5.99 is the basic plan for Hulu. Alternatively, you can choose to get an upgrade for some add-ons like ad-free streaming plus and shows from other cable networks. However, Hulu does not simultaneously release shows as traditional networks broadcast them. Typically, users have to wait a week before they can watch it on Hulu.

YouTube

If you want a more accessible entertainment app, then YouTube is for you. It comes as a pre-installed mobile app for most Android devices while you can download it from the App Store for iOS. Creating an account is also not much of a need if you only want to watch free content.

YouTube serves as a venue for creators to showcase their original content and videos through their respective channels. For years, it has been a great way to discover talents and online sensations. Nowadays, there are countless so-called YouTube vloggers sharing videos about almost anything, from comedy to tutorials.

Alternately, you can subscribe to YouTube Premium if you want an uninterrupted experience across YT videos, music, and gaming. That aside, you can also avail yourself of paid channels and pay-per-view services if you want to watch movies on YouTube.

Amazon Prime Video

Prime Video is the subscription service component of Amazon Prime for watching on-demand videos. It might not be the most popular video streaming platform but it is surely constantly catching up to its giant competitors. What makes Prime Video unique is the availability of pay-per-view purchases of its content if you don’t want to commit to a month-long subscription.

For a good amount, subscribers can access a huge catalog of movies and TV Shows, from the classic cartoons that will bring you nostalgia down to the famous movie franchises of today. Prime Video also has original shows available like The Marvelous Mrs. Maisel, The Expanse, and Bosch. Users can also download titles from Prime Video for offline streaming. Access Prime Video on smart TVs, computers, mobile devices, and even on gaming consoles.

HBO Now

HBO has recently joined the line of video-on-demand providers. Earlier in April 2020, it launched HBO Now as an à la carte streaming option for those who love to binge on movies. This means that you don’t need to have an existing HBO subscription (that service is known as HBO GO) to avail of the HBO Now service.

In terms of the content, HBO Now is pretty much the same. You can still enjoy all the premium content from HBO and watch the channel’s most popular shows and Warner Bros. movies. The good thing is that you no longer have to worry about missing an episode. You can watch all of them any time you want using smart TVs, computers, consoles, and even on mobile devices.

If you already have an existing HBO subscription, you can use HBO GO instead to stream based on your preference. HBO GO is also available on Amazon Prime.

Disney Plus (Disney +)

Disney+ is also among the latest additions to ease the growing demand for subscription-based television streaming. If you want to relive your childhood memories of fairytales and animated movies, then subscribing to the new service will keep you on the right track.

Disney+ gives customers instant access to Walt Disney Studios and Walt Disney Television content. It also has a good number of original shows and TV series that are only available on the platform. That aside, it also offers shows from blockbuster franchises like Marvel and Star Wars as well as Pixar and National Geographic. Disney+ is not yet available globally but is rapidly expanding. Learn more about how to use Disney+ on mobile in this article.

Crunchyroll

If you are an anime fan, you might have heard of Crunchyroll already. But for the benefit of those who don’t know, Crunchyroll is a platform where you can watch anime series and other Asian drama series. It has a huge collection of content, from cartoons down to cult hits like Naruto and Classroom Assassination. Most of them are free to watch, but some titles require a paid subscription to get access.

Once you subscribe, you’d have the chance to access all Crunchyroll content from any device. Not only you’d have access to an extensive media library, but you also get to watch ad-free, in HD quality, and ahead of everyone else. Premium members have a chance to watch simulcasts of episodes as they air in Japan. This includes professional subtitles to make sure no fan is left out.

Roku

Not all our favorite shows are on a single streaming platform. We love Stranger Things from Netflix and Game Of Thrones from HBO at the same time. A neophyte would download and subscribe to two different services just to watch these shows. But, jumping from one streaming platform to another is a bit taxing. Thankfully, Roku comes to the rescue.

Roku is a black box that turns a regular TV into a smart one. It’s like a digital media player where you can access content from different services. While you can add some channels for free, Roku might charge you when accessing content from more exclusive services such as Netflix, Hulu, Disney+, and more.

What makes Roku more interesting is that it has a mobile app version where you can binge on the channels that you own. As long as you have a steady internet connection, watching your favorite series from different services would be easier. Alternatively, you can also use the app as a remote control. Follow this article to learn more about how the Roku Remote App works.

Tubi

If you are looking for free streaming services, Tubi is a good alternative. It might not be one of the mainstream streaming services out there. Nevertheless, it is an impressive platform if you love watching older shows and movies. Tubi is not bad for its twenty thousand titles from Paramount, MGM, and other Hollywood giant distributors. Nowadays, you can enjoy different box office hits on the platform such as Star Trek I, Fist of Fury, and Big Jake.

You can also enjoy Tubi on your mobile phone. A stable internet connection is the only thing you need. Since Tubi is free, you must also be very patient with ads. As the company puts it, they can’t make TV shows and movies completely free and without ads. Here’s a complete guide on how to use Tubi on mobile.

Starz

When we speak of streaming movies over the internet, there is a tendency to overlook Starz. Originally, it is a premium cable television network that is strictly exclusive for over-the-air programming. But in 2016, it joined the fray of over-the-top subscription service and is now competing with the streaming giants like HBO, Netflix, and Hulu.

There are several ways you can watch your favorite Starz original titles on your schedule. You can watch it on smart TVs and computers, but the most convenient way could be through the mobile app. With the Starz mobile app, you can enjoy the best Starz originals like the Outlander, American Gods, and Vida on the go. Don’t think Starz is worth it yet? Read our Starz App Review to know more about the service.

Vudu

Vudu is not your usual movie streaming platform. Unlike other entertainment apps, it doesn’t require you to subscribe and doesn’t charge you a fee every month or at any intervals. Instead, it allows you to pay for every movie or series you watch. To simply put it, it is like a DVD rental store. But instead of getting a physical copy of the titles, you get the digital version of them over the internet.

There are a handful of full-length movies and TV shows on Vudu from different production companies. Vudu distributes content from Columbia Pictures, Lionsgate, Walt Disney, Universal Studios, and more. That aside, Vudu also has a huge collection of free-to-watch movies, shows, and TV series.

Vudu is available across digital streaming devices like smart TVs, computers, consoles, and of course on mobile. Here’s a complete guide on how to use Vudu on mobile devices.

Vimeo

Vimeo is the closest competitor to YouTube. But, it differs from YouTube on a great scale as well. YouTube has a huge collection of content from casual vloggers, while Vimeo focuses on the artsy side. It allows users to view professional and self-made videos for free like music videos, inspirational content, and even recipe tutorials. However, for content with copyrights, you’ll need to buy them first before you can watch them on the platform.

You can’t watch Vimeo videos on TV apps, computers, as well as on mobile devices. Here’s a detailed guide on how to watch Vimeo on mobile.

Best Photo Editing Apps on Mobile

Best Photo Editing Apps on Mobile

Photo sharing is among the common things people do on the internet. Social media users often share snaps to update their friends on what they are up to. But nowadays, we no longer share just ordinary photos. Truth is, most of us rely very much on photo editors to enhance them aesthetically. After all, who doesn’t want a photo to look appealing whether it’s to be sent to your friends, partners, families, or on social media? However, choosing the best photo editing apps and even photo collage makers is far from easy. Thankfully, you no longer have to agonize over choosing the mobile apps as we provide you the best of them here.

Snapseed

Applying digital filters can completely transform the photos you share. That’s what Snapseed focuses on. This photo editing tool for Android and iOS has several filters that can quickly change the mood of your photos. With a few taps, you can make your photos more elegant or more artistic. Aside from pre-setting filters, the app also allows users to manually adjust the color and contrast of the photos. It also has the basic tools of a photo editing app like the brush tool, spot repair, and cropping. Follow this Snapseed tutorial to learn more about editing photos on mobile.

Canva: Graphic Design & Logo Maker

If you want to up your photo editing skills, you can use Canva. Businesses usually use this app for making graphic designs as well as other visual content. But, you can also use the app to edit the photos you share on your social media account. It has a lot of features that give you control over how you want to edit your photos. It has free templates and grids for collaging photos. You can also add frames, stickers, and texts. All these are for free. But we know that everything free has a better version.

When you subscribe to the premium service of Canva, you’ll have access to a superb version of the app. It has millions of premium stock images, more templates, and larger cloud storage, among others. Discover what Canva is in this article and learn how to use the app.

Adobe Lightroom Photo Editor

Lightroom is an easy-to-use yet powerful photo editing tool for mobile devices. With the app, you can make dramatic changes to the photos you intend to share. It has presets such as filters to enhance photos in a single tap. You can also manually enhance color, contrast, and exposure to the app’s simple editing tools. You can also add blur effects or shift the focus of your photos. Adobe Lightroom is free for Android and iOS. But if you take a lot of photos and need to edit them, you can avail yourself of the premium Adobe Lightroom.

Adobe Photoshop Express

If you need to quickly edit photos, there is no question that Adobe Photoshop Express is for you. This app, available for Android and iOS, has instant filters as well as adjustment and correction options to quickly enhance your photos. Other than that, Adobe Photoshop Express is popular for instantly creating photo collages. Combine it with an auto-enhance tool and spot removal, and you can create a photo-ready for sharing in a minute.

Face App

Apps that instantly transform your selfies are on the surge nowadays. One of the most popular ones is FaceApp. It is one of the mobile apps that rose to fame for its ability to change someone’s face in a photograph in a snap. With the aid of artificial intelligence, it transforms faces to look younger or older, changes gender, and even switches a nationality. Its free version has over 21 filters. As if that’s not enough, you can try the Pro version to get full access to its filters and touch up your photos with a single tap.

VSCO

VSCO is a camera app and a photo editing tool in one. That said, users no longer have to switch over different apps to take photos and edit them afterward. Just take a snap and you are stepping ahead on sharing a perfect photo.

This app also offers an impressive collection of filters that could add a classic touch to your photos in an instant. Alternatively, you can adjust filter strength to match the mood you want to achieve. That aside, the app also allows users to adjust some properties of photos like the sharpness, contrast, and clarity. Once you achieve the edits you want, you can post your photos on your social media directly from the app. If not, you can download more VSCO filters by subscribing to the premium service.

Best Mobile Video Editing Apps

Best Mobile Video Editing Apps

Sometimes, photos just don’t express as well compared to a video. And most of the time, videos that are taken raw don’t just seem as appealing as those taken by a pro. Luckily, there are plenty of video editing apps available nowadays that’ll give a little boost to your videos. So, it’s time to say bye to those overpriced video editing software and start editing remotely with just a few clicks. Don’t worry, we curated some of the best video editing apps that are suitable for both beginners and pros.

In-Shot Video Editor

If you’re an aspiring video editor, InShot is a great tool for beginners. The video editing app allows you to create effects, add filters, and more. You can create a video for any type of social media platform. Alternatively, you can also adjust a certain picture to fit various frames. The app comes built-in with frame sizes for IGTV, Tiktok, and the likes. InShot has a ton of filters you can choose from, as well as stickers and text. Not to mention, an easy-to-navigate interface and a ton of editing capabilities. This cross-platform-friendly app is perfect for editing on the go.

Filmmaker Pro

Filmmaker Pro is another great video editing software. It has all the basic features of iMovie, but slightly better. You can cut and splice clips on your phone, as well as change the speed. You can even connect the app to your iTunes account so you can add songs from there. The app also comes with a ton of filters to help you add some color. While the settings aren’t as detailed, it’s still perfect for beginners who want to experiment with color grading.

Viva Video

VivaVideo gives you more options than your average video editing app. The app has built-in features that will help you make the most out of your videos. You can capture clips directly from the app with its camera. You also have the option to edit clips or have the app compile a quick slideshow for you. On the editing page, VivaVideo will give you themes to choose from. Depending on the video you are editing, you can choose a specific theme to fit it. Once you choose a theme, the app will automatically add effects and filters to your video. All in all, VivaVideo is great for quick editing.

GoPro

The GoPro app is meant to complement the camera of the same name. If you have a GoPro camera, you can connect it to the app. This will allow you to adjust the GoPro camera settings easily. You can also get a live view of what the captured image or video will look like. The GoPro app is great for backing up files on your GoPro camera as well. The GoPro app also has features to help you edit your GoPro clips. There aren’t many tools available for editing, but you can do basic editing just fine. Because it’s specialized for the GoPro, you can edit 360 videos on here as well.

Adobe Premiere Rush

Adobe Premiere Rush is a slightly more advanced video editing app. You get more functionality out of this than most apps in the market. The app promotes seamless editing from device to device, with a great backup system to boot. With Premiere Rush, you can shoot and edit your videos as easily as that. All you’ll need to do is sync your media files to the Creative Cloud and you can access it anywhere. You can add text and other media layers to your Adobe Premiere Rush videos. It also gives you the option to import voiceover clips to your videos. The app is free to use with some limits. You can purchase a full version to get unlimited access to the app’s features.

LumaFusion

For aspiring filmmakers, LumaFusion is the best app for you. The app goes beyond basic editing to help you create more in-depth videos. LumaFusion supports multi-layer editing and sound imports. The app even has its free music library you can get soundbites. Its comprehensive features are enough for it to rival even the best desktop apps. All in all, the LumaFusion app lives up to its desktop counterpart’s reputation.

KineMaster

KineMaster is a two-in-one app where you can capture and edit videos at the same time. The app has an exhaustive toolbelt you can use. You can use KineMaster free of charge, which is a great deal. You get great features like multi-layering media and various effects. KineMaster supports a wide range of animation effects, color grading, and text. You’ll have to deal with the KineMaster watermark. But it’s a small price to pay for what you get from the app. You can opt to get the Premium version which will unlock more features. These include added effects and exporting without watermark. If you’re looking for a more advanced editing tool, KineMaster is for you.

iMovie

iMovie is the built-in iOS video editor app. It’s exclusive to Apple devices and is very handy. The interface is straightforward and intuitive, which is perfect for beginners. You can develop basic editing skills here. You can cut and splice clips as well as add some background music. iMovie also lets you sync your files to iCloud, so you can enjoy your edited clips anywhere. While the video editing options aren’t as advanced, it’s still a great built-in iOS app when you’re on the go.

Must-Have Messaging Apps to Stay Updated

Must-Have Messaging Apps to Stay Updated

Thanks to today’s smartphones, messaging is more convenient than ever. With a steady internet connection, you can message anyone anytime! There are a ton of mobile apps in the market that offer various features to help connect you with loved ones easily. These mobile apps tend to be cross-platform friendly. This means that you can access them outside your phones. Whether you’re at home using a computer or on the go, you can use them seamlessly. We’ve compiled a list of the best messaging apps on the market.

Facebook Messenger

Launched in 2011, Messenger is Facebook’s official messaging app. Originally, Facebook had an in-app chat feature that you could use to message friends. Over time, they developed their messaging app to give us the best way to communicate. And while this means it will eat up more storage space on your phone, the app’s features make it worthwhile. Complete with chat, voice chat, and video chat, Messenger has it all.

You can customize your chat colors as well as chat emoji. You can send photos and files, as well as social media links. Perhaps Facebook Messenger’s most unique and notable feature is the chat head. This allows users to access conversations easily even outside the Messenger app. This feature has yet to come to iOS users, but we’re hopeful that it soon will.

Another popular messaging app would be WhatsApp messenger with its unique memoji. This widely-used app has over 11 million downloads. Of all apps in this list, WhatsApp is perhaps the most secure messaging app. Using end-to-end encryption, WhatsApp ensures your messages remain safe and private. WhatsApp may not be as cross-platform friendly as other apps, but it has a great backup system. You can connect WhatsApp to Google Drive and easily back up any of your conversations. The app also syncs to your phone’s contacts, so you can chat with anyone without eating up phone charges.

Telegram

An underrated messaging app, Telegram offers a ton of features to make messaging easy and fun. The app has all of the standard chat and voice chat features, although no current video call features. It also allows you to join chat channels and share media files of up to 1.5GB. Telegram’s media sharing system has a great file manager to segregate each file type. This allows you to locate any files shared easily.

One of the unique and fun aspects of Telegram is the in-chat games. Thanks to its bot support, you can invite any Telegram bot to play games in your group chats. Games like Werewolf, Quizarium, and LumberJack for a fun time with friends. You can download Telegram on Windows, Mac, Android, or iOS.

WeChat is an all-in-one messaging app but it’s most popular in China. They call it the “Everything App.” One small QR Code can go a long way with this app. Aside from typical chatting and calling, you can share media files and your location with your friends.

The mobile app also lets you send money to friends and pay at establishments and as a payment mode when you shop and dine. With just a click, you’ll find shopping alternatives and order from menu items. It also has a social media function that lets you share photos and links on your profile with all your friends.

Line

As one of the most popular messaging apps, Line is famous for its cute stickers and interface. The app has customized emojis and stickers that are exclusive to the app’s users. Many of the Line characters are very popular figures in pop culture. They even inspired Line’s spin-off app Webtoon, where you can read Korean-style webcomics.

In fact, this messaging provider has even partnered with big names such as Kpop group BTS to create even more unique characters like the infamous BT21. You can even upload stickers of your creation. Though stickers are the most notable aspect of Line, it also has other great features. It has a mobile payment system you can use to pay for shopping or transportation. From chatting with friends, buying items, and finding jobs, you get everything you could ask for with this app.

Viber

Viber is another underrated messaging app. It features an intuitive, easy-to-navigate interface. It provides you with all of the basic chat functions. Messages, media sharing, location, and emojis. However, you can only chat with friends if they have a Viber account. But once you get them to create accounts, you can get all of the wonderful features. You can easily create an account in a few minutes, so it shouldn’t be a problem.

Skype

Founded by Microsoft, Skype is one of the most popular messaging apps available. It supports international messaging and calls and has lots of tools to help. Skype can accommodate group video calls of around 25-50 people. It also has options for screen sharing available on any platform you use the app. Not to mention, the app’s video call quality remains unparalleled. You also have options to show whether you are online, busy, or invisible. That way you control who to chat with. Many people and organizations mainly use Skype for team coordination.

Hangouts

Hangouts is the official Google+ messaging app. You can use Hangout to communicate with your Google contacts. You can opt to chat with them, but the platform is widely known for its video chat feature. Google+ developed Hangouts to automatically detect and show the screen of the person who is talking. For this reason, many use Hangouts for remote live streams and presentations.

Discord

Discord is a great chat service perfect for group messaging. Created for gamers, the app lets you create group servers with a ton of cool features. You can add customized emojis for your server, as well as bots with various uses. There are bots for playing music, bots that referee games, and so on. The app also has a voice chat and screen share feature. This is perfect for coordinated activities like gaming. Discord servers can garner up to 250,000-500,000 members depending on whether it’s verified or not. You can download the app for your phones, but also on your laptops and PCs as well. You can also access the site on your browser without downloading it.

KakaoTalk

With over 150 million users, KakaoTalk is one of the most notable messaging apps. You can sign up for a KakaoTalk account using your phone number. Consequently, you can talk to any of your contacts that have registered for the app. The app supports group messaging, as well as video and audio calls. KakaoTalk comes with fun features like voice filters you can use in calls. There is also a wide array of animated stickers you can use to express yourself. With KakaoTalk, you’ll have a fun, lighthearted time with friends.

Zoom

Zoom is the pioneer in modern enterprise video communications. However, whether you’re seeking a video conferencing app for work or e-learning, this app is surely something for you. It’s easy to use with a reliable cloud platform for video and audio conferencing. This app provides the flexibility to conduct live conferences or pre-recorded messages. It comes with an array of operational options to fit all Android, Apple, and Windows users.

Best Mobile Dating Apps

Best Mobile Dating Apps

If you’re ever worried about meeting new people, dating apps are a good way to do so on your mobile. Technology has made it easy for us to connect to people all around the world. So if you’re looking for The One, you may not have to look far. Thanks to these mobile dating apps, you can match with anyone with the same interests as you.

There are countless love stories nowadays of people meeting through dating apps, with good reason. If your current lifestyle doesn’t let you meet new people as much as you would like, give these mobile apps a try! You can also check out our list of the best dating apps for more recommendations.

Tinder

The most notorious dating app on the market, Tinder helps you connect to people in your area. Tinder popularized the swipe-left and swipe-right style of matching. The app will present you with possible matches based on location and common interest. You can either swipe right if you like them, or swipe left if you don’t. If both of you swiped right to each other, then it’s a match! And you can both start a conversation. You can create a profile to showcase your personality, from photos to questions you can fill out.

Thanks to Tinder’s popularity, there are a lot of apps you can connect to Tinder. You can use Facebook to help narrow down your search based on your profile interests. Spotify will also let you showcase your music taste and choose an anthem that best represents you.

Coffee Meets Bagel

Founded by three sisters, Coffee Meets Bagel aims to change the online dating game for women. This uniquely designed dating app provides women with profiles of men that liked them. The women ultimately decide who they want to match with. This app was the sisters’ answer to studies showing that more men than women were active in online dating. And also that they were more aggressive on certain platforms. To cultivate a safe environment for women, Coffee Meets Bagel allows women to make all the decisions.

Bumble

Developed by a co-founder of Tinder, Bumble promotes a safe dating space for women. Whitney Wolf Herd created Bumble inspired by her own experiences at Tinder. She made it in the hopes of creating a dating app to give women a voice. That said, Bumble uses the same location-based, swiping mechanics as Tinder. But on Bumble, women message their matches first. This app aims to revolutionize the complicated relationship between misogyny and the online dating scene. While largely known for its dating features, Bumble can also help you connect with new friends or business partners with Bumble BFF and Bizz.

Hinge

Hinge aims to connect people looking for a more serious, committed relationship. The app’s design allows you to get to know your matches a little bit better before initiating a conversation. Much like most dating apps, Hinge will ask you to create a profile. The more detailed, the better. Users then get to comment on a specific part of your profile. In which case, you’ll decide if you want to pursue this match. With Hinge, you have more control over who you match with, even without swiping right. Thanks to this algorithm, you get a feel of what it’s like to talk to a potential match without full commitment. And when you do decide to talk to them more, you can have better conversations.

OkCupid

Based on the dating site of the same name, OkCupid helps you find deeper matches. The well-known dating site moved to the app scene a little late. But, it retains a lot of the features we loved that are still proven effective. OkCupid will ask you to fill out a very detailed profile curating your interests, hobbies, and opinions to find you the perfect match. Though tedious to some, this will only enhance the app’s algorithm. The matches you get will be more meaningful, as you gain more in-depth conversations in the process. OkCupid promotes a connection that goes beyond taking things at face value. Which is more than we can say for popular dating apps of today.

Happn

Mostly location-based, Happn allows you to meet people within the vicinity. The app’s tagline is, “find the people you’ve crossed paths with.” And there’s something romantic about the prospect of falling in love with a stranger you passed by. It sounds like a meet-cute waiting to happen. The app still has a long way to go, and there are still improvements to be made. As you’ll most likely be paired with people within your area, matches might be limited. But on the upside, Happn ensures safety above all else. And who knows? Maybe The One is (literally) just around the corner.

Badoo

If you’re looking for something a little more casual, Badoo is for you. Unlike other apps we’ve mentioned before, Badoo gives you control. You can either meet people with common interests, as well as ones in your area. The basic app is free, but there are also payment tiers you can choose from. The higher the tier, the better the features. You can do things like have your messages read first, or undo your “No’s.” The app also requires all the users to take pictures with specific poses upon registry. This is to ensure that the photos on your profile are completely yours. And this lowers the risk of catfishing as well.

Facebook Dating

Facebook released its dating features in 2018. This is in partial fulfillment of their promise to rebrand Facebook as a way to make meaningful connections. Although people commonly use Facebook to connect with real-life friends, the app promises not to reveal your dating profile to any of them. One unique feature of Facebook Dating is its suggestions. The app suggests potential matches based on mutual events or groups. There is also the Secret Crush feature, which allows you to list down a Facebook friend you secretly like. If, and only if, they list you down as well, Facebook will suggest the match. It’s a bit risky to create a dating profile on Facebook, as it stores a lot of your personal information. But in a way, it will only help you cultivate relationships founded on niche interests.

Grindr

One of the pioneers of dating apps, Grindr helps connect queer users everywhere. While mostly associated with hookup culture, the app became one of the cornerstones of the queer dating community. With over 3 million daily users, you can find your match with this app. The app initiated the swiping system that most dating apps do today. The app’s interface makes it easy for you to find matches and form connections. Grindr has many special features such as customized emojis and the Explore function. But perhaps its most notable feature is the Discreet App Icon. This allows users to change the app’s logo on your home screen so it doesn’t appear as it seems. You can choose from specialized icons that will hide the app but remain distinguishable. Grindr remains one of the most popular dating apps in the US.

HER

HER is an online dating app whose market is essentially lesbian, bisexual, and queer women. Designed for queer women by queer women, HER is an inclusive dating platform. HER lets you customize your profile settings based on what relationship you’re looking for. You can also include your gender and sexuality in the profile, with a comprehensive list to choose from. What’s great about this is it goes beyond the standard “gay” or “straight,” options you see on most dating apps. According to HER founder Robyn Exton, they made Her with the vision of letting you express yourself. This will help you find the best possible match you are looking for.

The League

The League is an exclusive dating app dubbed “Tinder for elites.” It has arguably the most selective vetting process to ensure maximum security. And also to ensure that you are among the best and brightest. You can apply for an account and create a profile, but that doesn’t mean you get in. The League will examine your profile, as well as linked social media accounts. From there, you can either get waitlisted or rejected, just like a college app. (That must be the reason it’s called the Ivy League of dating apps.) Though the concept sounds pretentious, that only means the people you’ll meet there are very successful. So if you’re a bit of an overachiever, then this might be for you.

Outstanding Music Apps

Outstanding Music Apps

Gone are the days when you have to rely on the radio to find good music. With the best music streaming apps, you can find your favorite songs in a flash. There are a ton of music apps with a diverse library of songs you can listen to. A lot of these mobile apps will allow users to curate songs into playlists. This makes it easier to find the songs in a similar vein. In doing so, it also helps users find more niche songs reflecting their music taste. With these mobile apps, you can find songs to help you express yourself even on your mobile. Learn how to download music from Spotify to mobile and more…

Spotify

One of the most popular music streaming mobile apps in the market is Spotify. Spotify updates regularly and has a ton of cool new features you can try every time. With over 50 million songs in their repertoire, who wouldn’t want to try it out? The app has a unique, eye-catching, and sleek interface. Spotify lets you curate your playlists, and generates a few of their own. They also create personalized playlists based on your activity. The app works great for updating you on the latest singles and albums. You can also share your favorite songs on social media, and see what other friends are listening to. Make sure if Spotify is the best for you as compared to other music streaming apps like Google Music or Amazon Music.

SoundCloud

SoundCloud’s streaming service focuses more on self-made tracks. SoundCloud is a great way to upload your music without undergoing a vetting process first. Because it’s a free service, you’ll likely interact with ads a lot. But you can upgrade to a more premium version without it. With SoundCloud, you can discover new, independent artists outside of the mainstream. Soundcloud provides a great platform to be discovered. Users can also mark down their favorite parts of a certain track, and comment on it. You can follow your favorite artists and enjoy their music.

Pandora

If you’re looking for a more vintage feel, Pandora will work for you. They designed Pandora to be similar to a radio. You can choose from various genres and stations, and go through a list of songs. With Pandora, you’ll be pleasantly surprised. If you’re using the free version, you’ll have little to no control over what song comes next. Perfect for discovering new songs you never thought to listen to before. Pandora also lets you like tracks from specific playlists. Not to mention, it has a growing Podcast selection with lots of great titles.

YouTube Music

YouTube recently ventured into the music scene with YouTube Music. While the app is primarily known for videos, its fast-rising Music app is getting more recognition. YouTube Music boasts a vast library of songs and podcasts you can easily peruse through the app. It also integrates well with YouTube’s main app. YouTube Music allows you to play YouTube videos outside the app, or when the screen is closed. Though it’s a paid service, you can get a free trial of the app. Nevertheless, its multiple features are definitely worth the buy.

Shazam

Don’t know the title of the song you heard at a party? Shazam has you covered. This unique service offers to search for any song playing at any given moment. Just record a short clip of the song, and Shazam will find it for you. The app also comes with Spotify integration. This lets Shazam create a playlist of all of the songs you’re looking for and find it on Spotify. You can seamlessly enjoy listening to new music with this service.

Musi – Simple Music Streaming

As its name suggests, Musi operates in a pretty straightforward way. The app gives you access to a music library and will help you stream them. Musi connects you to YouTube’s library. You can find and bookmark your favorite tracks for easier access. You can even find YouTube videos on the app and play the audio. Even when you exit the app, it will play in the background. The app automatically sorts your saved tracks alphabetically, helping you find them easily. It’s a straightforward service you won’t regret using.

iHeart: Radio, Music Podcasts

iHeartRadio connects you to various radio stations in your vicinity. You can easily discover new music and podcasts with this wonderful app. While the free version works great on its own, you’ll get more access to the premium. For a low price, you can get skips, pauses, and plays. Otherwise, it works as a typical radio would. iHeartRadio also lets you play through stations ad-free. You can listen to both AM and FM radio with this app, which allows you to get news updates easily.

SiriusXM-Music, Comedy, Sports

SiriusXM is an all-in-one audio streaming service. Not only do you get access to music, but comedy, news, and Sports as well. You can use SiriusXM on various devices seamlessly. It’s compatible to use on most cars, too. Which makes it the perfect companion when you’re stuck in a traffic jam.

TuneIn – NBA Radio & Live News

This unique streaming service allows you to listen to more than just music and podcasts. It also lets you stream live sports updates as well as news. They give live updates of every NFL, MLB, NBA, and NHL game. It streams news from college football games as well. TuneIn might be a paid service, but you get what you pay for and more with its features. Not to mention, you can apply for a free trial to test things out. Never miss a game again with TuneIn.

Deezer

Deezer has a whopping 56 Million songs in their library, with over 7 million users. The service lets you find great new songs to listen to anywhere. Deezer has both a free and premium service. The free service will still give you a lot of features, but with limited access. With the premium service, you get unlimited skips and downloads. Deezer’s Radio has over 30,000 channels to browse. You can spend a whole day getting lost in the app.

Top Productivity Apps

Top Productivity Apps

With our busy lifestyle, it’s often hard to keep track of things in day-to-day life. Thanks to the mobile apps market today, work and schedules are made easier. There are some of the best productivity apps to help you with tasks, meetings, reports, and get things organized. Studies show that the more organized a person, the more productive they are. So, it’s clear that these mobile apps are here to save the day.

Gmail

Tech Giant Google has truly lived up to its name, with the Gmail app being a prime example. Gmail is Google’s official mailing app. Anyone with a Google account can use the service. On the surface, it operates just like your standard mailing app. But once you get the hang of it, you can customize Gmail to reach its full potential. Some great features include sending scheduled emails, undoing sent emails, Gmail synced contacts for fast sending. The latter, of course, occurs provided you’ve toggled settings beforehand. Since its first integration, Gmail has remained a superior mailing app used by professionals and casual users alike.

In case you need some help on how to sync contacts to Gmail, here’s how it works.

Microsoft Outlook

Microsoft’s email management app, Outlook, runs with OneDrive. The app offers much more than a typical email app. Designed specifically for office work, you’ll find a lot of great tools here. It works seamlessly with other Microsoft tools. Most notably, it comes with Skype integration. Outlook also comes compatible with multiple add-ons such as Evernote, Dropbox, and more. You can even apply for an account for your entire company to get more specific features.

Yahoo Mail

Yahoo Mail is perfect for beginners. Its simple, sleek design will help you manage your emails easily. The app has a no-frills approach to email, which is all you’ll need. The app has some added features, such as integrating with other Yahoo services. You can get notifications for Yahoo Groups directly to your Yahoo email. You can also customize your email background, font text and color, and more. If you’re looking for a simple app with no bells and whistles, this is for you.

Google Docs

Google Docs is Google Suite’s word processor app. You can create documents and either leave as is or export them to multiple file types. You get all of the features of a standard word processor and more. The best part? Google Docs remains online. This could save you a hefty amount of space on your device. Google Suite also makes collaboration easier. With Google Docs, you can give other accounts viewing, editing, or suggesting access. This will make it easier for group reports or document editing. You can find your files on the app, but they will also be stored on Google Drive for better access and sync.

Google Drive

Google Drive is Google’s cloud-storage provider. It supports all file types from Google Suite and more. You can upload up to 15GB worth of files with a standard account. This includes your data from other Google apps as well, including Gmail. However, you can upgrade your subscription to 100GB. With Google’s cloud storage, you can access your files anywhere, any time. With unlimited access to Google Suite, you can manage files seamlessly.

Google Calendar

Google Calendar, as its name suggests, is a calendar app. You wouldn’t expect a calendar to come with so many features. But Google Calendar delivers in more ways than one. Under Google Suite’s theme of collaboration, you can use Google Calendar with peers. The app will let you create collaborative calendars. You can oversee and manage projects with this easy-to-use app. You can disseminate tasks, arrange meetings, and so on. Google Calendar also lets you view all of your Calendars in one place. That way, you can see if any events overlap with events from Other Calendars. With this app, you’ll never get double-booked again.

Google Sheets

Google Sheets is Google Suite’s spreadsheet app. It operates similarly to other spreadsheet apps like Microsoft Excel. The app’s excellent features allow you to collaborate with colleagues easily. With Google Sheets, you can also keep track of update history. That way, if you’re tracking expenses, for example, you can reference the date quickly. Google Sheets also supports linking to other sheets or other tabs for easier access.

Dropbox

Among the many cloud storage providers available, Dropbox is perfect for storing larger files. The file management system runs on smart sync. It can easily backup any files on your device with ease. It also offers high security, which is perfect for sensitive documents. The app supports both Microsoft and Google’s app suite. The upload and download speed works wonders as well. Upgrading might be on the pricey side, but it’s worth it for all of the great features you can get.

Microsoft One Drive

OneDrive is Microsoft’s cloud storage app. It supports online and offline sync of files in the Microsoft suite. You’ll get 15GB of free storage with a Microsoft account. But you can upgrade your plan for more storage space. With OneDrive, you’ll be able to manage all of your files easily. OneDrive has multiple organization features that make it a cut above the rest. It syncs across devices seamlessly as well. With Microsoft OneDrive, you don’t have to worry about managing your files.

Microsoft Word

Word is Microsoft’s word processor app. It works wonders with any task you need to get done. From writing reports to essays, to simply taking down notes. Microsoft Word’s simple, easy-to-navigate interface allows easy use. The app works well on iOS and Android devices. However, it works even better with tablets. Word’s compatibility with the Apple smart keyboard and pencil will help taking down notes much easier.

Microsoft Excel

Excel is Microsoft’s spreadsheet app. When you hear the word spreadsheet, you generally think of Excel. People have been using Microsoft Excel for quite a long time and for a good reason. While the app remains perfect for basic use, Excel also supports advanced functions. Whether you’re doing basic accounting for personal or business use, Excel has you covered. You can also use Excel to keep track of and manage projects. With Excel, Microsoft aims to make your work easier.

Microsoft PowerPoint

PowerPoint is Microsoft’s slideshow app. You can create dynamic presentations and reports with PowerPoint. The app comes with standard templates, fonts, and colors you can use. It also supports templates from third-party sites. That is, so long as it uses the compatible file extensions used by PowerPoint. The app will also let you customize slides with animation, making more interactive presentations. Whether for work or fun, making reports is easier with PowerPoint.

Travel and Commuting Apps

Travel and Commuting Apps

Travel planning and research is always a crucial step to an efficient and hassle-free journey. And the good news is that you no longer have to do these things alone. There are these mobile apps that will get you the information you need just with a few clicks. Regardless of whether you are traveling on business or for fun, these mobile apps are sure to make your traveling experience worthwhile. Amazing travel deals are right at your fingertips.

Airbnb

If you’re just looking for places to stay for the night or are trying to find out new places and activities to keep you occupied during your next trip, Airbnb is your best bet. The site allows you to book travel tours from anywhere in the country. It also shows you available home rentals that are more affordable than traditional hotels. You can also book reservations for yourself and your pals to restaurants near your place of visit. You can even book other experiences such as cooking classes and live music shows. Book the best deals for the best travel experience with Airbnb now.

Expedia: Hotels, Flights & Car

Expedia is another great traveling app that will let you book anything from flights, hotels, and rental cars. Unlike Airbnb, Expedia focuses more on efficiency. It allows you to find, research and book a place to stay and the transportation you will need to get there. Although the app is not exactly inclined towards providing unique travel experiences, it is very efficient at the essentials. This app can get you to where you want to be on time and in a hassle-free manner. Get the perfect hotel, flight, or car service with Expedia.

Booking.com: Hotels & Travel

Booking.com is a travel and lifestyle app based in Amsterdam. The app allows you to research and book hotels and other lodgings. The app generates a list of all available hotels and inns in any selected area. A Booking Assistant allows users to modify their bookings based on their preferences, and also communicate with the company even before getting to the destination. The app also provides the user with a map guide to the chosen location. Book the best deals for the most convenient travel experience with Booking.com now.

Yelp: Food & Services Around Me

Yelp is perhaps most popular for its reviews of food and restaurants around the city, but it is much more useful than that. The app is an effective navigation guide for exploratory night-outs and other trips around the city. It functions as an upgraded, modern-day equivalent of a Yellow Pages directory. You can search for new restaurants, bars, cafes, and whatnot in any area that you’re in. The app can generate thousands of business listings, photos, and reviews of any category, depending on how large your search grid is. If you are the type who likes to explore new cities on foot, this app is sure to be a handy helper.

Hopper: Flight & Hotel Deals

Hopper is one of the popular booking mobile apps focused on flight and hotel arrangements at discounted prices. It’s a relative newcomer to the travel and booking section, so it’s understandable why certain risk-averse individuals might want to head straight to the airline website to book flights. Nonetheless, the service hasn’t had any issues and appears reliable thus far. And since most people aren’t experts on discounts and such, they included an in-app advisory regarding the best deals. This means you no longer have to sift through the list of random deals because the app will summarize the best ones. You can pay for your deals right through the app. It will also let you know how much you can save over time. Save your hard-earned cash and get the best deals on flights and hotels with Hopper.

Hotels.com: Book Hotels & More

Hotels.com is a great repository of the best hotels in the country. It provides access to thousands of hotels and rooms. Everything on the app has photos and a full description, so you will always know what you pay for. You can book the best deals by checking in the Deals for Tonight features. There’s also a deal that allows you to have one free day if you book ten days into specific hotels. You can even ask for discrete discounts and increase your savings. Get the best deals for flights, hotels, and other services with Hotels.com.

TripAdvisor

TripAdvisor is a multipurpose travel app that lets you do almost anything. You can book flights, cruises, hotels, and restaurants right through the app. You can even book entire packages with a cruise, flight, and hotel included. Feel like skydiving or rock climbing? You have the option to check out the things you can do for a certain area. There’s also a listing of the highest-rated services for the year. Besides this is a travel forum to help you get an idea of what other tourists think about a place. The layout might feel a little cramped with a few hotel ads, but it makes up for this by showing the best deals. Book a complete travel package with TripAdvisor now.

Skyscanner

Skyscanner is a booking service ideal for long-range travel. The app offers the whole package: cheap flights, hotels, and car hire. This lets you book the best flights and hotels for no added fees. You can book hotels, flights, and rental cars in advance at the best prices. This app will save you the pain of having to sift through hundreds of hotel websites and presents you with the best deals right off the bat. The app is also noted to be customer-friendly with excellent customer service support. It also gives you the option to save flights that interest you without having to book them right away. You are also advised about eco-friendly and shorter routes for your bookings. Get the best deals for travel with Skyscanner now.

Uber

Uber is a ride-sharing app developed for city-based navigation. If you need to get to any place fast, Uber allows you to book a ride with just a few clicks. The charges vary depending on the demand for the service and the traffic situation on your selected route. Uber also provides an option for saving money through ride-sharing. The uber and uber pool options will take you where you need to go at affordable prices. But if you have the money, you can also opt for a high-end vehicle to pick you up. Real-time mapping features let the drivers know where to pick you up and where to drop you off. Unlike a regular cab, you don’t need to give any special instructions whatsoever.

We also appreciate the fact that the app makes its users feel safe. You are given information about the vehicle details and the picture of the driver. You can also provide feedback about the service or the driver after you’ve been dropped off. This is more interactive than other services have to offer. You can make your payment through cash, credit card, and PayPal. Get to your destination fast with an Uber ride now.

Lyft

Lyft is a free ride-hailing app offered by a transportation company of the same name. Like Uber, the app pairs you with a driver nearby to take you to any location This is especially useful for when you have appointments to catch or are suddenly lost in an unfamiliar area. In-app systems allow you to key in your destination so the driver will know where to pick you up and where to drop you off. You can add multiple forms of payment. You can even ask for help from your Lyft friends when you run short of cash. It’s also supported by mapping applications, the most prominent of which is Waze. What this means is that you can book a Lyft ride and indicate your destination right through the app. Get to your destination safe and sound with Lyft.

Never Get Lost with These Navigation Apps

Never Get Lost with These Navigation Apps

Gone are the days when you needed a physical map to familiarize yourself with an area. Nowadays, all you need is an internet-connected phone or tablet and you’ll be able to search for any place and view it using any lens. Regardless of whether you need a map to navigate to your next meeting or are simply exploring new places to dine at, you could do it with the help of a little help from these mobile navigation apps. You can check out our list of the best Android GPS apps for more recommendations. Don’t worry, these mobile apps don’t cost much but they’ll help.

Google Maps

This navigation app is hands-down the best mapping and navigation app on the market. It’s crowned the best and also offers the largest repository of detailed maps in the world. Equipped with a myriad of features, this app serves as a navigation guide, scheduler, planner, and personal assistant all at the same time. This is a highly empowering tool in terms of allowing people to see the world, even interplanetary objects, and allowing them to get to any place they would like to be. Google Maps is also integrated with Uber and Lyft. Navigate your way to greatness with Google Maps now.

Waze

Waze is a free, community-driven GPS navigation and mapping app. The app is the go-to software for car drivers for navigating the city. Waze also uses crowdsourced information to populate its maps. This means that all updates and details came from the users themselves. One thing to note about Waze is that it was designed for city navigation. This means that urban areas would have much more detail than rural areas on the maps.

With an internet connection, the app can guide you through the streets via voice-guided GPS navigation. Aside from GPS navigation, the app also specialized in real-time traffic and incident data. This is great for avoiding any traffic and roadblocks along the way. There are also route recommendations customized to your preference. You can also use it to find specific places such as restaurants, bars, and even gasoline stations. Send your current location to your friends and even chat with them while using the navigation function.

Here WeGo

Here WeGo is a mapping and GPS navigation app. The app started as the navigation app for Nokia Android devices. The app has a great interface, detailed maps, and offline functionality. For GPS capabilities, you will get accurate mapping and traffic updates while on the road. The app offers various options for customization. You can also look into any area and change the view and the specific layers.

The layers can also be combined to give you a better vantage point. If you’re going to places without an internet connection, you can download maps of entire cities beforehand for offline use. Unfortunately, the GPS function doesn’t work offline. But you probably can get by with the basics. Get to where you need to be, with or without an internet connection, with Here WeGo.

Sygic GPS Navigation & Maps

Sygic is another mapping navigation with offline functions. Although not as sophisticated as Google Maps or Waze in terms of design, the real-time maps of Sygic are accurate. It has basic features including 3D maps and accurate GPS navigation capabilities. There are also real-time speed limit warnings and lane integration arrows for added guidance while you drive. You can also get information about parking spaces available in the area. Besides, you can create your routes and bookmark your favorite places. Maps are downloadable for offline use. Whether you are traveling or commuting to work, Sygic is sure to be a useful tool.

MapFactor Navigator

MapFactor Navigator is a free GPS navigation and mapping app. The service relies on the Open Street Maps service to populate its repository of maps. This means all of its maps have been created and updated by a large community of map enthusiasts and dutiful online users. Thus, the app benefits from the OSM repository of maps covering more than 200 countries worldwide. The app also boasts turn-by-turn GPS navigation in different languages. There are also real-time traffic and speed limit warnings. Join the local community’s passion for navigation with the MapFactor Navigation app.

Maps.Me Offline Maps

Maps.Me is a free GPS navigation and mapping app for Android, iOS, and Blackberry phones. It’s one of the largest sources of offline maps for travel and outdoor activities. The app allows you to download specialized maps for driving, walking, bicycling, and even subway commuting.

Aside from having an accurate GPS, the app also features different layers for viewing traffic, a map editor, and a smart search function. Users can also save bookmarks of favorite locations on any map and hire help from city guides in the area. Lastly, the app is integrated with Uber and Booking.com for convenience. Get your dose of navigation fun with Maps.Me now.

Scout GPS, ETA, Maps & Traffic

Scout is considered a social navigation app. This means it lets you navigate the social realm as you navigate your geography. The most special feature of the app is the ability to initiate a chat with friends and family. One click of a button also automatically shares your location and ETA for they know how far along you are. You can instruct the map to show you the way via visual markers while your phone is online. It also automatically computes your ETA and calculates the optimal routes. Voice navigation is also possible, but this comes with a monthly subscription. Navigate anywhere with the Scout GPS app.

Health and Fitness Must-Have Apps

Health and Fitness Must-Have Apps

Everyone needs a little help and motivation to keep fit. The same is true for relaxation and winding down after a hard day’s work. Whether it be slimming down or gaining more muscle, you need a daily reminder to help motivate and inform you of your progress. You might also need a daily guide to help you relax and meditate. If you are lacking your daily dose of motivation and information, health and fitness mobile apps might help.

Health and fitness apps are essentially hidden gems of the app world. They will help you keep track of your fitness and health objectives. And when it comes to selection, there are different varieties of health and fitness apps. Most are related to short workouts, nutrition, and activity tracking. There are also those designed for meditation and relaxation. These apps are the closest thing to a personal trainer or spiritual guide that you can have, and they all have. They are also very discrete and personal so you can engage in your hobbies on your own time.

Calm

Rated as one of the best mobile apps in the market, Calm does wonders to help you sleep better. The app features a collection of walk-through meditation programs and stories. These are available as either audio narrations or readable text. There’s also a collection of relaxing instrumental music that will help you either fall asleep or meditate. Some of these are free while some need to be purchased. These are things you can listen to in the middle of a hectic day or before you go to sleep. You also have the option to set a timer for the app to turn off so that you can go straight to sleep. Meditate towards your best self with the Calm app today.

Headspace: Meditation & Sleep

Headspace is a mobile app dedicated to teaching meditation techniques. If you want to clear your mind to get a better perspective of things, meditation always helps. Unfortunately, we live in a world with so many distractions that it’s almost impossible to focus. This app can help you do just that. There are audio guides that will teach you meditative techniques at different levels. There’s also relaxing music for when you just want to sleep. You can even include your children while the audio. It might help them relax for a bit as well. Stop those restless nights from affecting your health with the wonderful Headspace app.

MyFitnessPal

MyFitnessPal is a fitness and nutrition app. As far as informed exercise goes, this app is doing its part to promote that. It works both as a personal fitness and nutrition tracker. You can keep track of your daily caloric intake and log your physical activities within the day. Of course, you will have to be honest about these details for it to work. There’s a special log for your daily weight so you’ll know if you are meeting your personal weight loss goals at a healthy pace. You can also input your meals and water intake to know if you are eating the right amount. There are also plenty of tips and tricks for healthy eating you can apply for life. Get healthy and fit with the MyFitnessPal app.

Sweatcoin – It Pays to Walk

Most of the most popular mobile apps pay to live better. Sweatcoin is a reward-based motivational app for walking. That is, it encourages you to walk to earn coins for prizes, vouchers, and offers. If you are looking for ways to get motivated to exercise, Sweatcoin is providing the incentives. Sweatcoin uses GPS to track all your outdoor steps within the day. Being GPS-based also means it can run without an internet connection. Unfortunately, walking indoors will not count. So circling your backyard is not a good idea. The more steps you take outdoors, the more coins you earn. And you can exchange Sweatcoins for discounts on real products. Walk the talk with the Sweatcoin app now.

Nike Run Club

The Nike Run Club is a master of all running guides. It has plenty of them in audio form. There are also personalized coaching plans for those who are trying to maintain or lose weight. You can even track your heart rate with the app. It’s also great for keeping note of your progress over time. You will just need to note down all your running sessions. The app will reward you with trophies and badges when you have reached certain milestones. You can also invite your friends to run distance challenges. With all features, the Nike Run Club is a useful guide for your daily fitness journey.

However, if you prefer something more like abs and core training, endurance training, or yoga, Nike Training Club is a good option. It’s available on Android and iOS.

Lose It! – Calorie Counter

Lose It is a calorie counter and food diary application. You can input any food and the app will generate average calorie counts. As an add-on, you can also input your daily food intake to generate your food patterns.

By inputting your weight loss goal, the app can generate suggestions on daily calorie intake. These are scientifically-based computations that have pre-calculated weight loss effects. Take note that over-restriction is not recommended as this could have drastic consequences on your health and daily energy levels. You need to stick to these caloric budgets for a specific period to be able to lose weight gradually.

The app can also suggest meal targets for each food group to keep you satiated while trying to lose weight. Lose weight and keep healthy with a subscription to the Lose It! App now.

MINDBODY: Fitness, Salon & Spa

MINDBODY functions booking and business directory app for all kinds of fitness activities. The Mindbody directory contains over 52,000 businesses offering fitness-related services. These include classes for yoga, pilates, and circuit training.

This also includes listings for dance, boot camp, and cycling, among others. The app is also connected to businesses offering services for post-exercise relaxation and beauty. This includes massages, facials, cryotherapy, etc. There’s also a fitness tracker, calorie counter, and scheduler for your classes. Explore health and wellness offerings through the Mindbody app.

Noom

Noom is an app-based personalized weight loss and coaching program. It gets you in touch with professional doctors, psychologists, nutritionists, etc. Your trainers will create a personalized diet and workout plan for you. Scientifically-proven approaches are intended to help you develop healthy eating habits. These are also intended to help you change negative mindsets and deal with any existing body issues.

There are also plenty of online resources accessible to you to keep you informed and motivated. There are also plenty of tracking tools on the app to help you monitor your progress. Reward yourself with the best assistance regarding your health with Noom.

Lifesum: Diet & Macro Tracker

Lifesum is a mobile self-care fitness app that helps you eat better and lose weight. The app is a one-stop shop for information about the most popular and effective diet plans. Examples include the keto diet, fasting, and sugar detox diets.

The app also can generate customized diet plans based on several self-tests. It also includes recipes and suggestions for healthier eating. There’s also a calorie counter to keep track of food consumption per day. Find out the best diet plans for yourself with the Lifesum app.

Stay Alert with the Best Weather Apps

Stay Alert with the Best Weather Apps

The weather used to be very unpredictable. But with the advent of weather apps that tell you how it’s going to be for the day, it becomes less so. And with weather conditions becoming more extreme with climate change, information is key. Being informed and aware is always the first step towards being prepared. Know if you will need a large umbrella or a sunhat when you go out. Stop feeling under the weather with these powerful and accurate weather apps on your mobile today.

The Weather Channel

The Weather Channel is a free and comprehensive resource for weather information. The app provides you with all the information you need to know related to the weather. This includes temperature, wind, and visibility on an hourly and daily basis.

You will also get notifications for severe weather in your area. This also includes forecasts for the days ahead. There are also large-scale visual maps to show the myriad of weather events. There’s even a section for allergy risk warnings. This is intended to help sufferers determine and prepare for seasonal allergy risks. Get the best weather information and updates with the Weather Channel now.

AccuWeather: Weather Tracker

AccuWeather is an informative and full-service resource for weather information. It provides users with details and information about the weather. The app looks like a source of information overload. Nonetheless, the information you need about your area is placed at the top. The weather prediction for the next twelve hours is included. So you’ll know by morning what the afternoon weather will be like. There’s also plenty of weather weather-related videos and radar information. If you like your daily weather information accurate and detailed, AccuWeather is the right app for you.

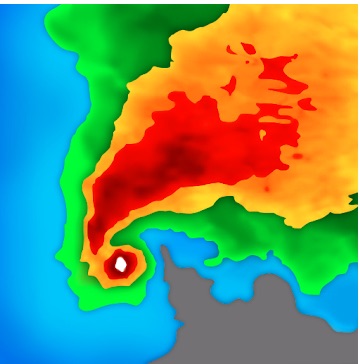

NOAA Weather Radar Live